The Federal Reserve decided to drop their target Fed Funds rate to an all-time record of 0.00% to 0.25%.

This chart, from Bill Luby's Vix and More, highlights the daily effective federal funds rate, which is a volume-weighted average of rates on trades arranged by major brokers. It puts things in perspective, doesn't it?

Not surprisingly, last Friday’s effective Fed Funds rate of 0.11% is a record low. In contrast, the record high of 22.36% dates back to July 22, 1981. The average Fed Funds rate since 1954 is 5.62%.

People Are Less Scared.

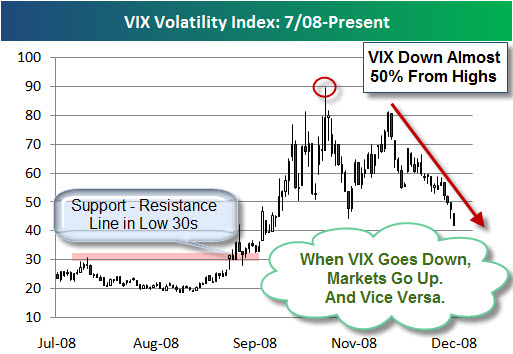

Something else going down is the VIX, which is now down more than 50% from its highs. The VIX looks out 30 days into the future and captures “event volatility” associated with events that are expected to occur in the next 30 days. These include Fed meetings, important economic data releases (employment report, consumer prices, retail sales, durable goods orders, GDP, etc.), earnings from bellwether stocks, even hurricanes, geopolitical crises and other events which can expect to cast a shadow over the course of the next 30 days.

As shown above, the VIX recently broke below its November lows and is currently resting just above 40.

The VIX typically goes up when the market goes down, but even on days when the market has declined this week, the VIX has gone down as well. That means investors are feeling a lot less fear.

What about the Government, though? If they are so confident, why continue to print money?

What's a Few Trillion Among Friends?

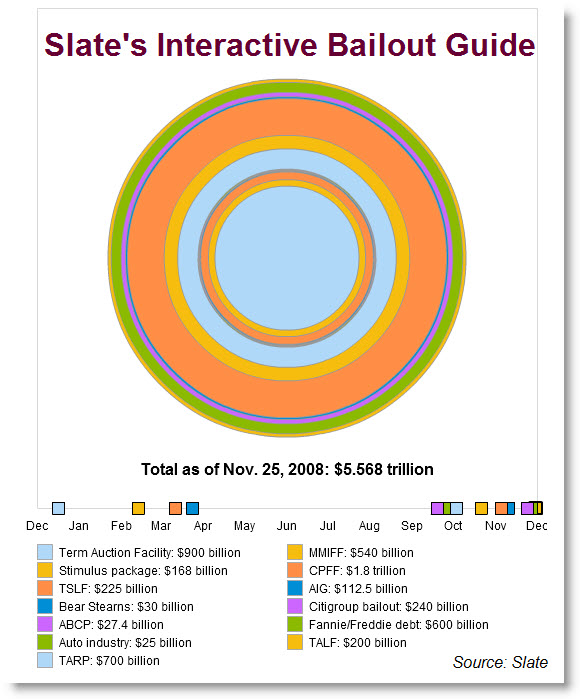

Since the economic-stimulus package in February, the government has offered more than a dozen multibillion-dollar rescue packages for a variety of industries endangered by the financial chaos and the recession. The magnitude of even one of these mega-bailouts is hard enough to grasp. The following Slate visualization attempts to put the magnitude of these rescue packages in perspective.

Here are a few other items that caught my eye this week.

- Is it a Bail-Out or Smart Economics? (Dash of Insight)

- Sy Harding Argues that Government Responses Will Limit Recession. (Financial Sense)

- Money flow up sharply as S&P holds 50-day Moving Average. (Fallond)

- Biggest 6-Day Decline Ever for the Dollar. (Bespoke)