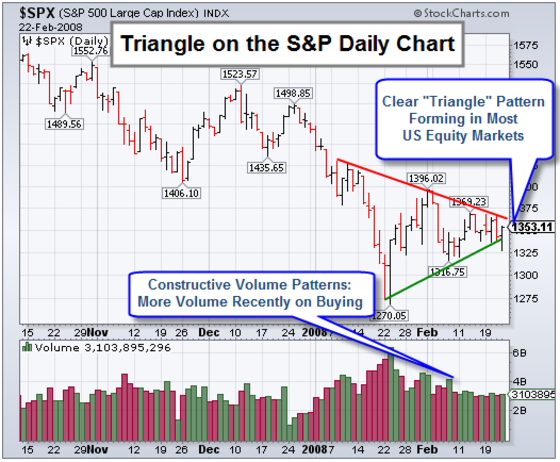

Market Commentary Most major US equity indices are in a "triangle" consolidation pattern (like the one shown in the chart below). I view this as constructive, even if it results in lower prices short-term. The bear-swing down, from late December through January, had a lot of momentum. The consolidation worked-off a lot of that. Consequently, another move down would result in many positive divergences – and would likely be strong support for the next rally.

Choppiness increased as we moved further to the point of the "triangle" shown above. It makes sense, doesn’t it? The upper and lower boundaries for market swing is getting smaller (both in size and in time). The result is choppiness – or volatility that we’ve seen recently.

Think of this as a well-contested battle between the bulls and the bears. Neither side has given-up much ground, yet. Soon, though, one side will have had enough and the market will surge again.

Every once in awhile I feel the need to remind people that regardless of my personal opinion, we rely on the mechanical trading models to determine our market posture. And that my comments are intended for information and context.