Who asked for the extra day in February anyway? Certainly not me. The week started great. Then investor confidence took another blow Friday as the S&P 500 declined by 2.7%; its worst day in a long time.

Who asked for the extra day in February anyway? Certainly not me. The week started great. Then investor confidence took another blow Friday as the S&P 500 declined by 2.7%; its worst day in a long time.

If you were watching, I don’t have to tell you how bad it was late last week. Bottom Line: oversold market conditions and a fair amount of manipulation from the sidelines has not been sufficient to move the market out of the consolidation range of the last several weeks.

The whipsaw volatility seen the last few weeks worsened Thursday and Friday. After attempts early in the week to take the market up and beyond the contracting Triangle patterns found on most of the US equity indices, the selling on Friday brought us down to levels where the lower-range boundaries of the Triangles are now clearly threatened.

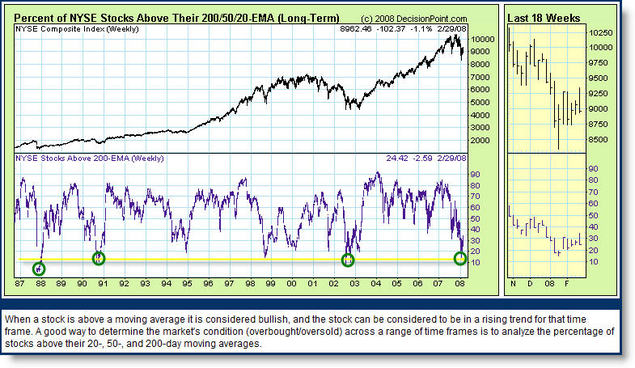

On the other hand, DecisionPoint had an interesting chart that may indicate we’ll see a major low soon. It shows the percent of NYSE Stocks trading above their 200-day moving average.