This was a very

interesting week. Tuesday saw the markets hitting new lows at levels

we first saw in 1998. Investors Intelligence says bearish sentiment is

now higher than it has been since then too.

Batman opened this week, just in time to see the warning signs over Gotham.

The SEC intervened

by prohibiting “naked short” positions against certain financial sector

stocks.

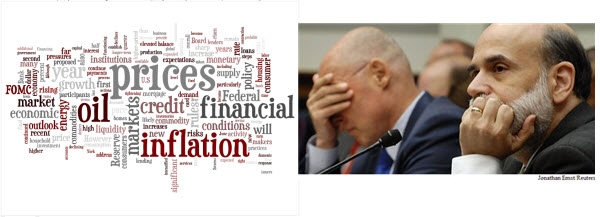

And apparently, Bernanke and Paulson had fun talking with

Congress.

On a lighter note, here is a clip from “The Daily Show”. President Bush and Fed Chairman Bernanke both spoke at the same time. John Stewart used this to highlight the similarity (OK, the differences) in their talking points. It was pretty funny.

Here are a few of the news items and blog posts I found interesting this week:

- Following Fleeting Fear – Yes the VIX did get over 30 for a brief moment (WSJ MarketBeat)

- Easy Money? Interesting commentary by Jeff Miller (Dash of Insight)

- SEC blatantly intervenes – Banning Naked Shorts of key Financials (Naked Shorts & Phil)

- Kudlow questions whether Failure is still an option (Kudlow)

- Investors Intelligence reports Bearish Sentiment highest since 1998 (Bespoke)

- S&P500 – Back to where we were Ten Years ago (Crossing Wall Street)

- Victor Niederhoffer on the buying opportunity in “Economics of Worry” (Daily Speculations)

- Prudent Bear fund sold; interesting business cycle indicator? (Pittsburgh Business Times)

- Fully One-Third of all NYSE Stocks hit 52-Week Lows on Tuesday (Quantifiable Edges)

- Putting Citi and BofA losses into perspective; check-out the chart (Kedrosky’s Infectious Greed)

- Have Banks Bottomed; and if so, for how long? (The Big Picture)

- Interesting thoughts on “non-bottom-callers” (The Financial Philosopher)

- Nice summary contemplating whether we just witnessed The Bottom (Humble Student)

And, a little bit extra:

- Apes to Get “Human Rights”? (BBC and Slate)

- iPhone Apps for Investors (Infectious Greed)

- Debunk the Funk – getting your mojo back (Tickerville)