It has been another strong week for fear, greed and volatility. Earnings season is here, and we are seeing large moves in both directions.

There continues to be unprecedented global cooperation in the wake of the financial crisis. The world seems to understand that it has to "snooze" the alarms until after the US election. The French have asked for a series of global summits to deal with the global financial crisis, with the first to begin after the U.S. election — and the last and most important to be held after inauguration day.

Stratfor claims that this shows two things. The first is how flexible many international crises are. They can wait for changes in political leadership. The second is how important the United States remains. If the United States had lost its leadership role, French President Nicolas Sarkozy would not have gone to Washington to get the Americans to agree to a summit. The rest of the world could proceed by itself. Most likely, that isn’t going to happen. The Europeans and Asians meeting by themselves would not be in a position to make any decisions. For that, the Americans need to be there. And since the Americans won’t have a new leader until February, the world financial crisis will just have to wait until then. My point? It would be prudent to expect fear, greed and volatility to continue.

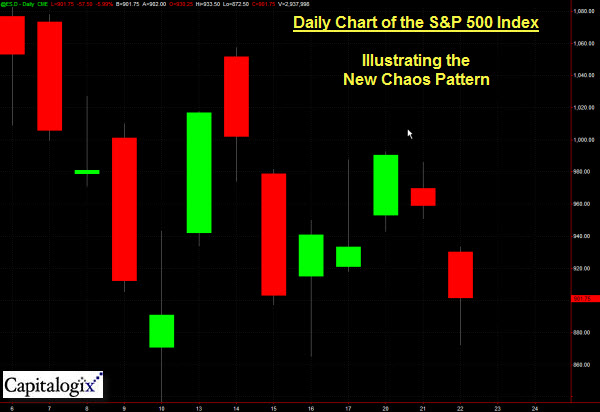

Looking at this daily chart of markets for the past few weeks, I'm struck by this seeming randomness. It almost looks like there's no pattern.

It is as if Jackson Pollock threw paint on our trading monitor and we mistook it for a chart. This utter lack of pattern might be an incredibly clear statement by the market. It says: "Danger, there is no edge here."

The strange thing about markets, though, is that what doesn't make sense from one perspective – may make a lot of sense from another. For example, here is a daily chart of the same S&P 500 Index, only showing a much longer window of time.

Hopefully that long-term support line (just below 800) holds.

Careless mortgage lending has created an economic crisis in America. But did you know that America is not the only nation struggling with the current economic situation? The International Herald Tribune reveals that the worldwide credit crunch is impacting Europe, as well. Small business owners, like Dominique Boudier of Paris, count on credit from their suppliers in order to function, but creditors are cutting their offerings in half. The suppliers’ credit insurance companies have ordered this reduction. Taking into consideration the 60-day lag time in which clients pay, Boudier’s business needs more cash flow to offset this major shortfall. Boudier fears the worst because her bank’s hands are tied, too; her bank, like many in Europe, put their money to sleep with the European Central Bank (ECB) instead of investing it in other banks and the rest of the economy. Bank failure led to the disruption of liquidity, and in turn, credit began to dry up. The ECB, like America’s Federal Reserve Bank, uses a system based on its ability to generate as much fiat money as needed. Fiat-money currency, which is basically credit money, loses its worth when the government refuses to guarantee its value. Inflation rates are on the rise. Many people think that responsible, private banking systems will solve this problem. Until the problem is resolved, payday advance loans will be accessible for consumers that need short-term financial help right now. They can’t wait on a faltering central banking system.

Post Courtesy of Personal Money Store

Professional Blogging Team

Feed Back: 1-866-641-3406

Home: http://personalmoneystore.com/NoFaxPaydayLoans.html

Blog: http://personalmoneystore.com/moneyblog/