Will Consumers Be Naughty or Nice This Holiday Season? There was a lot of commentary on the start of holiday season sales this week. The WSJ notes that bargain-hunters turned out in force for the "Black Friday" pre-dawn store openings and sales, but the annual frenzy was tempered by cautious buying amid the economic downturn. American consumers say they are less interested in consuming than at any other time in the past four decades. Still, the tone has been cautiously optimistic, so far, with the belief that more shopping is will shift online, even though online sales for the first three weeks of November are down 4% from last year. In a related article, the NYTimes suggests that TV sales are becoming the litmus test for U.S. economy, and offers a glimpse of the

broader tensions between cautious consumers and desperate retailers.

Still, the Market has gained 21% since its low made five trading days ago (when the S&P 500 hit a new low for this bear market and touched levels last seen in 1997). Many attribute this week's rally to some significant Government actions, such as:

- a rescue of Citigroup,

- the unveiling of President-elect Obama's economic team, and

- an $800 billion plan of attack to un-freeze lending to consumers.

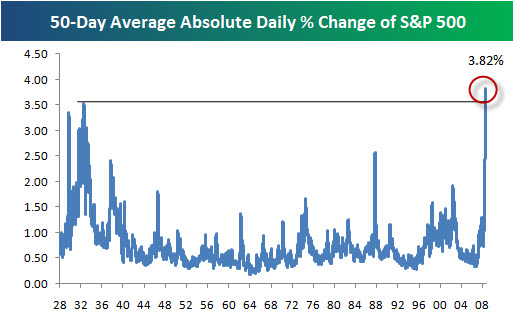

The Most Volatile Market Ever.

According to Bespoke, over the last 50 trading days, the average absolute daily percentage change of the S&P 500 has been 3.82%! That means the S&P 500 is averaging a daily move of up or down nearly 4%. This is definitely one of the craziest (yet most telling) statistics of the current bear market, and unfortunately, the majority of the daily moves have been down. In the history of the S&P 500, there has never been a more volatile period. The closest other period was in the early 1930s. In contrast, back in February of last year, the 50-day average absolute change was just 0.33%. Here is a chart that illustrates the spike in volatility.

What about Sentiment? Well, the CBOE Volatility Index (VIX) has moved beneath its 50-day moving average for the first time in almost three months. Given the inverse relationship between the VIX and stocks, some read this as a bullish sign.

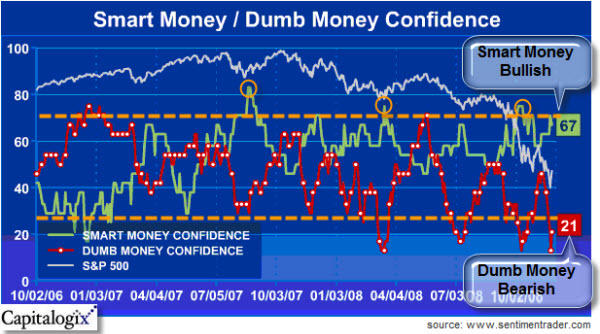

SentimenTrader's Smart-Dumb Money indicator. The Markets may still have some room to downside. Yet, in contrast to the bearish bets made by small traders, recent Commitments of Traders reports (and other indicators) show that large commercial hedgers (aka the "Smart Money") are quite bullish.

Historically, a confidence spread this wide only happens once or twice a year. Nonetheless, this is the fourth time we had such a sentiment spread this year. In practice, the Confidence Indexes rarely get below 30% or above 70%. Usually, they stay between 40% and 60%. When they move outside of those bands, it's time to pay attention. The chart above shows that substantial bullish reversals often happen when this occurs.

What Does This Say About the Spirit of Our Times? This may not be market commentary but it might show the zeitgeist of the business climate. McDonald’s wants to patent how it makes a hot sandwich. I guess that is the other side of the coin from when McDonald's got sued by someone who got burned when they spilled a 49-cent cup of coffee in their own lap.