Last week I said that it didn't matter whether we were in a depression or a recession. My basic rationale was that if you don't have a cure, then recognizing the disease provides little benefit. The second rationale was that much of the commentary I read talks about our troubles is if they're happening in a vacuum, when in fact, the whole world is suffering from similar financial challenges and instabilities. What that implies is that independent actions (or events that happen here in America) will have less long-term effect than hoped.

In medicine, I suspect that doctors would prefer to cure a disease rather than treat symptoms. On the other hand, until the disease is cured, treating symptoms can often make the patient feel a lot better. While governments around the globe look for a cure, investors will feel a lot better if they figure out a way to make money in this economy, rather than the one they hope for.

It amuses me when I hear that "markets went down today on concern that "XYZ" did ABC". No one really knows why markets go up or down. Sometimes markets respond favorably to news, but other times they don't. Ultimately markets go up when more people buy than sell. Conversely markets go down when there are more people intent on selling, than buying.

So when people insist on creating certainty around what caused markets to move in one direction or the other, I suspect this is a symptom that relates back to a tendency shared by many humans. We are naturally afraid of the dark. It's comforting to believe that there's enough light to see what's going on and to make sense of what's happening around us. It doesn't even really matter that we truly believe it, as long as it's believable and it makes us feel better.

So Where Are We? We are in an alternate universe. We have a wildly popular African-American President and the Cardinals in the Super Bowl. Remember Seinfeld? Castanza would be a Billionaire.

The market had another terrible week, including the worst inauguration day decline in history; but the White House has a new blog, so apparently everything is okay.

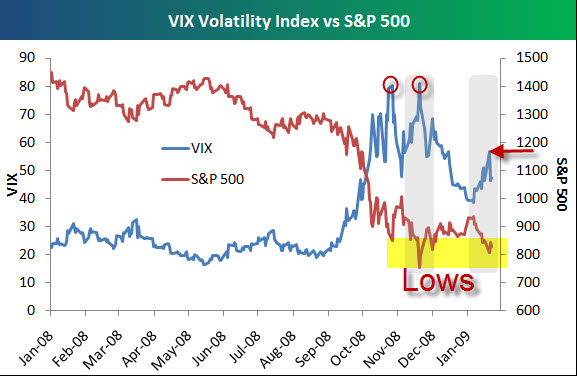

The VIX seems to be saying the same thing. According to Bespoke, one difference between the current decline and the declines in October and

November is that the VIX has not spiked nearly as much. Many think of the VIX

as an indication of fear in the market, and whether it's good or bad, there

seems to be more complacency during the most recent downturn. This chart shows the VIX volatility index along with the S&P

500.

Here are a few of the posts I found interesting this week:

- Obama's Inauguration Speech. (Transcript, Visualizations, & Commentary)

- No soft landing for Asian airlines. (WSJ)

- Despite Crisis, Jim Rogers is Still a China Bull. (Reuters)

- Are riots in Iceland, Latvia and Bulgaria are a sign of things to come? (Times UK)

- If Google can't make it work, newspaper advertising must really be dying. (SJ Mercury)

- Be Nice to Those Who Lend You Money. Another great Fallows piece. (The Atlantic)

- Thought Provoking Article discussing Business Cycles and Creative Destruction. (Guardian)

And, a little bit extra:

- The cure for retail doldrums … Obama has an action figure with "Presidential Accessories".

- Timely article called "Reading the Energies of the Time". (Quantum Think)

- W's Greatest Hits: Love him or hate him, these 25 BUSHisms will make you smile. (Slate)

- Open Source Democracy: The technology that helped elect Obama (AFP & .GOV)

- Pictures of Obama's Inauguration from Space; see a different perspective. (TechBoost)

- Super squeaky safe sex. Funny condom ads with balloon animals and bloopers. (Durex)

- Free video and worksheet from Tony Robbins about the Power of Momentum. (Nice tool)

Thanks for sharing this post