In Davos, they are holding the World Economic Forum. The tone is a little different this year.

Putin warned about the first truly global economic crisis,

which he says is continuing to develop at an unprecedented pace.

Soros said “Central banks have lost control,” and basically predicted a new economic world order and the end of the Dollar as the world's default currency.

So far at the Forum, the U.S. has played the role of the wounded giant.

Meanwhile, at home, the WSJ says there have been more than 70,000 layoffs this week alone,

something President Obama called "a continuing disaster for America's working

families." He urged passage of his $900 Billion stimulus bill and issued Executive Orders to increase the clout of unions.

Reports show the U.S. economy shrank about 5% last fall — the worst contraction since 1982. Because businesses failed to cut production fast enough after the financial crisis hit in October, they're now stuck holding vast inventories of unsold goods. In order to correct, they've begun aggressively closing factories and shedding workers. The Washington Post says the economy is sinking under the weight of this excess inventory, and that the data suggests the worst is yet to come.

This story is playing-itself-out in different forms across the globe. For example, I got an e-mail from a trader showing ships stacked-up in the Port of Singapore. This picture was taken a few weeks ago. Apparently these are empty ships, waiting for cargo. Since the docks are full of other empty ships, the result is a near complete slow down.

Question: Does that illustrate the state of the commercial world in the Far East? Or, perhaps, could it simply be the result of Chinese New Year celebrations? I guess time will tell.

Charts That Caught My Eye This Week:

The January decline was steep, but U.S. Markets held above their late November lows. Most surged

over their 50-Day Moving Averages, only to sink back downwards.

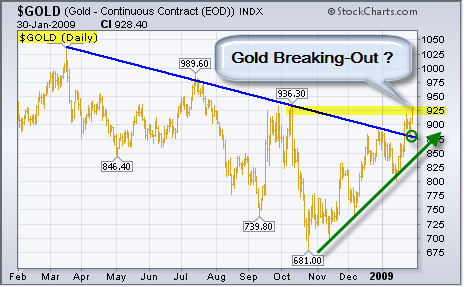

With Equity Indices suffering and Bond prices falling as well, is there anything performing well? Recently, Investors have turned to gold as a safe haven. It looks like gold just broke above and successfully re-tested its trendline. On a closing basis, Friday was the highest gold close in six months.

Here are a few of the posts I found interesting this week:

- Why Obama unloaded on Wall St execs, as JFK once unloaded on steel barons. (NYTimes)

- UK article spotlighting 25 people at the heart of the economic crisis (Guardian)

- Apple awarded key patent on things that makes the iPhone, the iPhone. (AppleInsider)

- Elliott Wave Theory's explanation of "irrational herding" during uncertain times. (Prechter)

- Americans display venturesomeness, even in grim economic stretches. (NYTimes)

- Steve Jobs a music visionary, or just visionary? Judge for yourself. Interesting article. (CNet)

And, a little bit extra:

- An attempt to make the ThinkPad sexy. I'll admit, they caught my eye. (Lenovo)

- Watch the Ads From the Super Bowl Online (Hulu)

- Add "Obama-cized Poster Effects" to your photos. Interactive and flexible. (Obamicon.Me)

- Malwarebytes fixed a Trojan for me that apps I paid for couldn't remove. Nice. (Download)

- Big Brother's Watching: Swiss Police Spy Marijuana Field With Google Earth (ABC News)

- Printing the NYT Costs Twice as Much as Sending Every Subscriber a Free Kindle (Silicon Insider)