Humor usually has its base in truth.

Perhaps that is why this cartoon caught my eye; it pokes at a sore spot.

It has been weeks since many people figured things changed. Not much seems better, yet, does it?

Emotions are not logical. So even though I might consciously understand that we are going through a long process, I want instant gratification. It is human nature. And that explains a lot about the market in-and-of-itself.

I once heard that a Recession is when your neighbor loses his job, and a Depression is when you lose yours. With unemployment spiking, a lot more people are feeling "depressed".

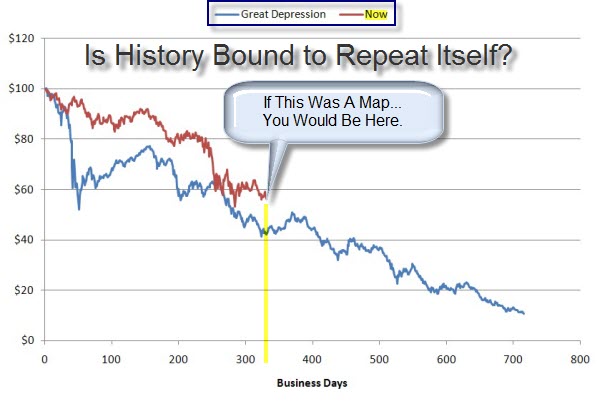

Market Commentary: The good news is that the lows held, and it looks like there's decent support at these levels. It is worth noting that we saw a strong rally anticipating the Senate's Stimulus Plan.

Déjà vu, though; didn't we see this pattern before? Last October the markets rallied off the lows in anticipation of the bailout deal, only to move down again once it passed. It will be interesting to see what happens to the market when the Stimulus Plan actually passes. Will confidence spur a further rally, or will speculators have to switch back to bear-mode?

The January Barometer Predicts a Down Year: I talked about this a few weeks ago; research published by Yale Hirsch in the "Stock Trader's Almanac" suggests that market performance during the month of January often predicts market performance for the entire year. This January Barometer has worked especially well in odd years (the first year of a new Congress), with only two misses in 69 years. While the January barometer has a good record of prediction, StockCharts.com still puts it in the "for what it's worth" column because, while it is interesting to note, it might simply be coincidental.

The January Barometer Predicts a Down Year: I talked about this a few weeks ago; research published by Yale Hirsch in the "Stock Trader's Almanac" suggests that market performance during the month of January often predicts market performance for the entire year. This January Barometer has worked especially well in odd years (the first year of a new Congress), with only two misses in 69 years. While the January barometer has a good record of prediction, StockCharts.com still puts it in the "for what it's worth" column because, while it is interesting to note, it might simply be coincidental.

It is hard to imagine 2009 being a positive year. As I talk to business owners, I sense a weariness and fear. The economy is catching up with them, directly or indirectly. An interesting side effect is that some of the more successful entrepreneurs I talk with are starting to get excited about the new opportunities in front of them. In contrast, several expressed feeling a little guilty and sad about their success in the face of what's happening around them. This is what happens during periods like this. Old models fall away and new leadership emerges.

Here Are A Few Of The Posts I Found Interesting This Week:

- Was All The Doom And Gloom At Davos A Contrary Indicator Of Better Times Ahead? (Slate)

- Obama's Wall Street Initiative: Getting beyond slapping the hand that feeds you. (Daily Beast)

- Doesn't Everything Use Flash Memory? SanDisk reports $1.8BB loss amid demand slump. (CNet)

- More tech troubles, Motorola Q4 loss of $3.6BB with sales falling 26%. (CNet)

- Are Morgan Stanley and Goldman Sachs showing new leadership? Price says "Yes". (Bespoke)

- Is Stronger Medicine Needed To Fix The Banking Crisis? (Barrons)

- Facebook growing 7X faster than LinkedIn, but that's not the whole story. (Silicon Alley Insider)

- Necessity is the Mother of Invention. A new class of start-up ventures (BusinessWeek).

And, A Little Bit Extra:

- Jennifer Hudson lip-synced the National Anthem at the Super Bowl. (ABC)

- Interactive Data Visualization of Twitter Chatter During the Super Bowl. (NYTimes)

- Crowd Behavior Explained; the herding instinct is chemical. (New Scientist)

- Mating Season Is Over for the Alpha Males of Banking. Wallet-size matters. (Bloomberg)

- Professor Uses Math to Decode What Makes The Beatles Music Special. (WSJ)

- Teleportation Is Now Real – Just Don't Try It at Home Yet. (Time)

- Verne Harnish Rockefeller Habits one-page strategic planning tool. (Classic & New Version)