The U.S. Markets moved higher for the fourth week in a row. This is just the fifth positive week for these indices in 2009.

The public notices! I had a guy approach me at the gym to ask if I thought he should start buying again. He said he knew it could go back down, some, but isn't that "dollar-cost-averaging"? And I got an e-mail from a friend asking me to recommend a trading course for his wife to take because she is starting to day-trade. Those things whisper that sentiment is changing. Hope the market does too.

Rally Symmetry.

While we are still in a downtrend on the longer timeframes, the size of the short-term rally is impressive. This chart shows that the S&P 500 Index has rallied 27% off its March lows.

This is surprisingly similar to the size of the bear rally swings we saw in October and November.

Is Rising On Bad News a Good Sign?

The latest report on job losses showed that the American economy shed another 663,000 jobs in March and that unemployment rose to 8.5 percent.

While the Dow Jones Industrial Average initially fell on the news, it quickly shrugged-off the data, and closed back above 8,000 for the first time since early February.

Bad news everywhere, and the Markets continued higher. I thought it was an April Fool's joke. It still may turn out that way? In my book, though, that is a bullish sign.

Another Bullish Sign, Markets Are Above Their 50-Day Moving Averages.

For me, most notable is that our major indices are now above their 50-day moving averages for the first time in a very long time. Even better, tech is leading the way. So until the 50-day is broken back to the downside, this market deserves some respect.

Yes, shorter term, markets are overbought … but they have been overbought for more than a week. I can't believe I'm saying this … remember that overbought can also be a sign of strength.

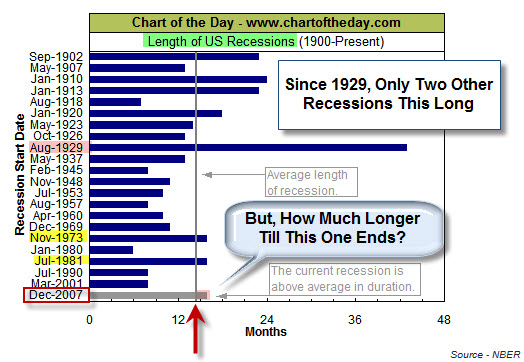

Recession Length.

While the stock market has rallied nicely since bottoming on March 9th, the economy continues to struggle. For some perspective on the current economic recession, the chart below illustrates the duration of all US recessions since 1900.

The five longest recessions all began prior to 1930. The length of the current recession (now entering its 16th month) is above average, and equal to the longest recessions (1973 & 1981) since the Great Depression.

Since it is unlikely that the Recession is over, the question is how much longer till it ends?

In addition, something I'm paying more attention to is the amount of talk I'm hearing about the inevitable devaluation of the dollar. Let me know what you think about it.

Business Posts Moving the Markets that I Found Interesting This Week:

- How Can Small Investors Get In on the Bailout? (NYTimes)

- A Few Drops Don't Make the Glass Half Full. (Barrons)

- Have We Nationalized Banks in response to the current economic crisis? (Duke)

- Credit bubble looms as investors rush to credit, distressed debt and CTA's. (Reuters)

- G-20 Expands IMF Lending Powers to $1 Trillion to reignite world growth. (WSJ)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Heart Muscle Renewed Over Lifetime, Study Finds. (NYTimes)

- Tax Day Tea Party: The resistance is brewing. (TaxDayTeaParty)

- Is Google In Talks To Acquire Twitter? (TechCrunch)

- AI Advance: Robot scientists can think for themselves. (Reuters)

- More Posts with Lighter Ideas and Fun Links.