Stocks continued their advance this week. The U.S. Markets moved higher for the sixth week in a row. Yet, it was just the seventh positive week for those indices in 2009.

Stocks continued their advance this week. The U.S. Markets moved higher for the sixth week in a row. Yet, it was just the seventh positive week for those indices in 2009.

It is worth noting that the bulk of earnings begin to hit this week. We'll see if people continue to buy into bad news. I'm watching for a change in sentiment.

Long-Term Market Reminder: We have been in a bear market. So, until proven otherwise, basic trend-following theory implies that the higher probability trades will be on the short side. That means selling rallies until the bear market ends.

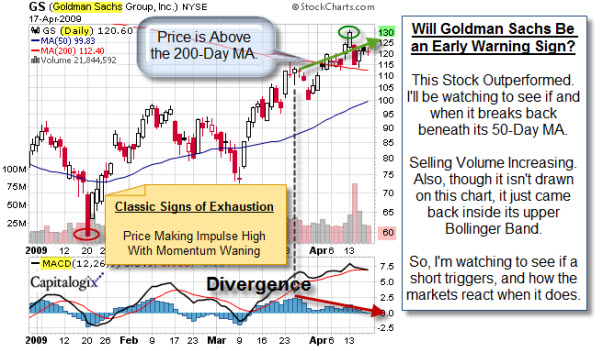

I sense a renewed interest in the market recently by retail investors. For example, just this week I had conversations with several people telling me that they regret not buying Apple and Goldman Sachs while they were down. I tend to hear this type of conversation at tops. Here is Goldman's chart.

It is also worth noting that there are reports that Goldman's Q1 Profit was non-recurring and a result of AIG unwinds. Add that to the fact that there we have seen poor bank earnings so far. Yet, it seems that the market sees a much higher likelihood of future financial solvency than it did just two months ago. Still, this is a sector I'm watching for signs of weakness. The next chart will explain why.

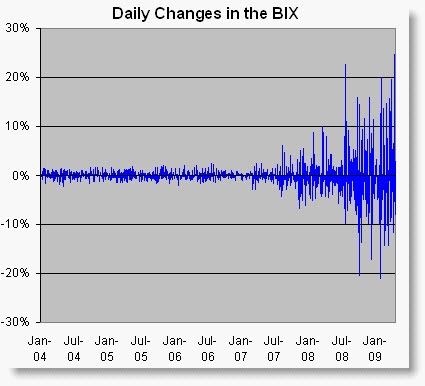

Here is an interesting chart related to banks from Crossing Wall Street. It could be titled "The Earthquake That's Shaking Our Markets". It shows recent volatility of Banking Index.

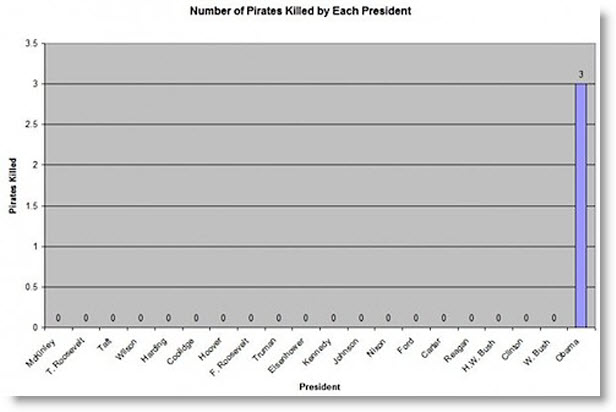

Finally, I thought this was funny. Our peaceful pacifist president has become Obama The Pirate Killer. Yeah, I know, the SEALs did it … But I like the chart anyway.

Business Posts Moving the Markets that I Found Interesting This Week:

- Earnings Are Horrible – And Why It May Not Matter. (Traders Narrative)

- Shiller Says Depression Lurks Unless There’s More Stimulus. (Bloomberg)

- Poorly understood facts about Employment Numbers. (A Dash of Insight)

- Ten principles for a Black Swan-proof world. (Financial Times)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Bullish Signs On The Wall of Worry. (A Dash of Insight)

- How High is Too High? (InvestorWalk)

- Things We Can Be Sure Of and Hopeful Because Of.(Financial Philosopher)

- People Need to Play More – It is important to Society. (LiveScience)

- More Posts with Lighter Ideas and Fun Links.