"Sell in May and Go Away" is a popular market aphorism. Still, the markets continue to hold up well despite less than favorable news. Usually I consider that a bullish sign.

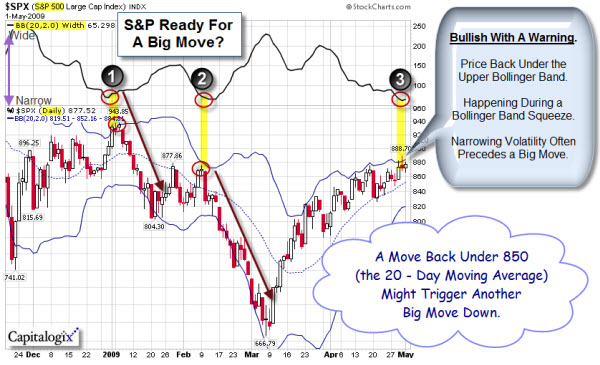

This chart shows that the S&P 500 Index has dropped dramatically the past two times it rose above its upper Bollinger Band line (indicating a market high), while the Bollinger Band Width was narrow (indicating low volatility). Well that is where we are again, and with low volume as well.

I am watching the 20 day moving average (which also serves as the recent up-move's trend line). A break below that might trigger another big move down).

This Week's Featured Market Chart.

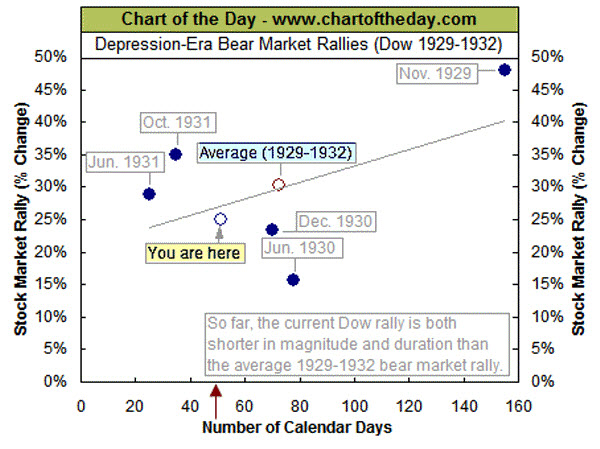

Many investors have looked at the early 1930s for some insight into the current economic/stock market environment. While there are significant differences in the global economy and political landscape between the current environment and that what occurred in the early 1930s, there are also many similarities (bank failures, bankruptcies, severe market declines, etc.).

For

some perspective on the current stock market rally that began on March

9th, the chart below illustrates the duration (calendar days) and

magnitude (percent gain) of all significant Dow rallies that occurred

during the 1929-1932 bear market (solid blue dots). For example, the

bear market rally that began in October 1931 lasted 35 calendar days

and resulted in a gain of 35%. As this chart illustrates, the current

Dow rally (hollow blue dot with the pale yellow "You are here" label)

is slightly below average in both duration and magnitude relative to

the average 1929-1932 bear market rally (hollow red dot, with the pale

blue label).

So, as big as this rally seems … It still might be a bear market rally.

What's Happening In the Legal Industry Says A Lot About the Market.

I

used to be a lawyer, and still have a number of friends who practice

law. I don't normally use law firm data as a trading indicator; but

these are not normal times. I suspect that there are a number of early

indicators we can glean from watching this industry sector.

First,

First,

this weekend a bankruptcy partner in a large Dallas firm told me that

he is seeing a big upswing in business. This implies a big increase in

the number of bankruptcies to be filed in the coming months. I'm

hearing similar things from friends around the country; that right now,

the hottest section in many law firms is its bankruptcy practice.

I

think that means that the economy hasn't fully digested the damage done

by the economic slow-down. Frankly, I'd be surprised if it had.

The

other side of that coin is that law firms are downsizing and laying-off

people because there simply isn't as much transactional work as there

used to be. The big example here is that Skadden Arps offered its associates one-third of their pay to take the year off.

At

Skadden, I'm sure many of them thought, nice work if you can get it.

However, I also suspect that a lot of talent will jump ship to

corporate jobs.

This might be the economic season that lawyers

start to pursue other business interests. Historically that has often

been a positive mutation for businesses. Research shows that a

disproportionate number of corporate executives have legal degrees.

So, I'm looking for more lawyers to join start-ups roll-ups during the

next downturn. And I'll take that as an early indicator of recovery.

When

legal transactional work starts picking-up again because of mergers and

acquisitions … I'll take that as an even better indicator that the

recovery underway.

Business Posts Moving the Markets that I Found Interesting This Week:

- Stocks End Higher As Fed Sees Recession Easing. (AP)

- Only 37% of WSJ Readers Said They Think The Economy Is Improving. (Forums)

- Semiconductor Sales Fall 30%, Continuing Sharpest Downturn In Years. (WSJ)

- In Major Shift, Apple Builds Its Own Team to Design Chips. (WSJ)

- Starbucks Reports Steep Earnings Decline. (NYTimes)

- Microsoft and Verizon in Talks to Launch iPhone Rival. (WSJ)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- You Can Catch Swine Flu From Money. (SmartMoney)

- Do You Have Swine Flu? Self Diagnosis Test. (DoIHaveSwineFlu.org)

- Michael Douglas to Reprise Gordon Gecko 'Wall Street' Role in Sequel. (FoxNews)

- Research Shows People Like To Exploit The Luck Of Others. (BPS Research)

- The Reverse Black Swan. (BW)

- Money Messes With Your Mind – Is Handling Cash An Anesthetic? (NewScientist)

- More Posts with Lighter Ideas and Fun Links.