The market has been tenaciously bullish recently. Apparently it's working, because I hear an increasing amount of people optimistic about the markets.

I'm glad that our trading is based on mechanical models, because recently mechanical models have worked quite well.

Personally, though, I'm feeling a lot more cautious. The markets seem pathologically bullish; and I am looking for a pull-back.

What concerns me is that we haven't seen the back and forth … two steps forward, then one step back, rhythm that I've come to trust. Instead I sense something artificial and likely to break down. For example, since this rally began in early March, there have only been four days with negative reversals greater than 1%.

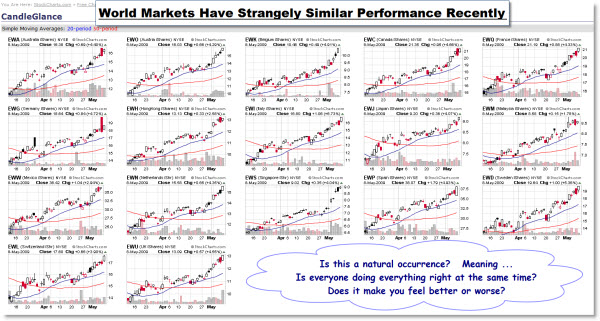

Can The Economies Of This Many Countries All Get Fixed At The Same Time?

Moreover, a quick glance around the globe shows remarkably similar bullish performance in many markets.

To get a closer look for yourself, here is a link to the charts.

Other Signs That We're Approaching Over-Extended.

I'm starting to see the Smart Money lighten up their bets at the same time I'm seeing retail investors starting to get back into the game; and the VIX is at a low not seen since last September. It feels like we are getting close to the type of confidence spread that often immediately precedes a major turning point. It is the point where the market is making higher highs, while smart traders are becoming more risk-averse. This negative divergence often perceives market pullbacks.

Again, in my opinion, a pullback from this level is expected and perhaps even healthy. What I'm looking for is to see a healthy correction and then, hopefully, organic buying from the Smart Money.

Elliott Wave Pattern.

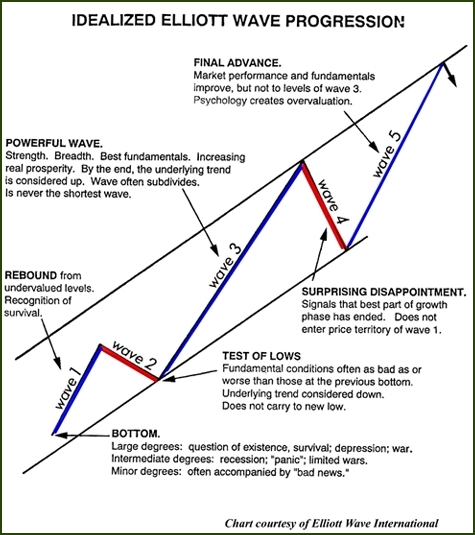

I was talking to a friend of mine who successfully trades using Elliott Wave as a framework for understanding the market. And I thought this might be an interesting time to re-visit this technique.

The premise is that the market doesn't affect sentiment. Rather, it is the other way around; collective sentiment affects the market. And that while markets change, human nature doesn't … consequently, predictable patterns play out over and over again.

While I now look at Elliott Wave more as a way of understanding what the market has done (rather than a great predictor of what it will do next), I do believe it is helpful in getting a sense of the next likely swing.

Here is a chart that shows the basic sequence and an example of the sentiment causing the move.

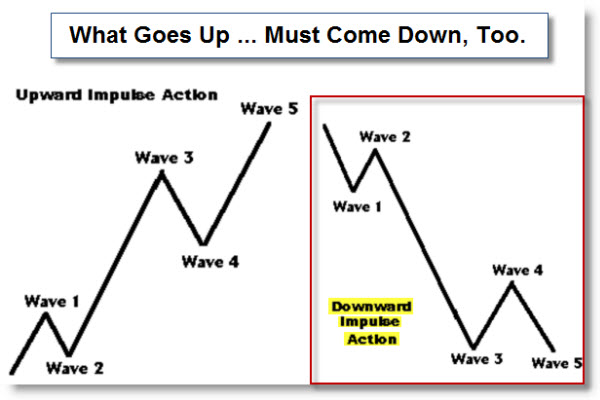

The next chart shows that a similar sequence often happens in both directions.

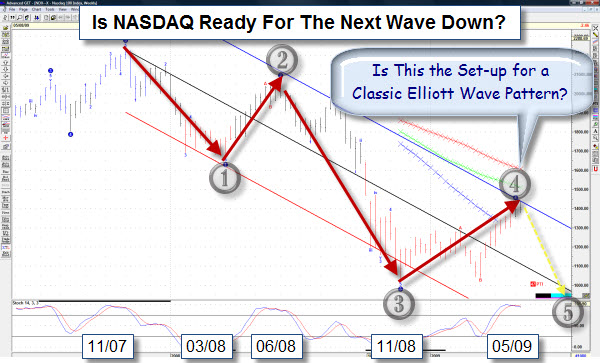

All this reminded me that I have a piece of software called the Advanced GET, which uses a pretty clever algorithm for identifying some of the simpler Gann and Elliott Wave trading patterns. So I dusted-it-off, fired-it-up, and started playing around.

Looking at a weekly chart of the NASDAQ, it's very easy to envision

a five wave sequence as follows.

Note that the wave five target

is beneath the recent lows. And that the wave four pullback takes us back to the top of the channel … and seems to have textbook Elliott Wave size,

slope, and timing.

Again, I don't trade

the Elliott Wave. Yet it fascinates me, and is something

that I do pay attention to as a framework. Add to all this that the daily chart of the NASDAQ shows

that price is stalled at its 200 day moving average, and I'm certainly going to be wary of a pull-back here.

Business Posts Moving the Markets that I Found Interesting This Week:

- Is The Recession Over? (Forbes)

- Wall St Continues to Rally; S&P positive for '09. (Reuters)

- Bernanke's Outlook A Bit Brighter, But Forecasts Slow Recovery. (WP)

- The End Of The IPO Drought Is Coming. (A VC)

- Venture Capital's Dilemma: the prescription for curing IPO ills. (Forbes)

- Economic View – Depression Scares Are Hardly New. (NYT)

- Feds Bailing Out States. (TDB)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Science Of Concentration: Multi-Tasking Is A Myth. (NYT)

- Amazon's Secret Weapon: Recommendations Based On Your Interests. (Forbes)

- Coldplay Plagiarism Claims Filed By Three Artists (PopEater)

- Funny Video – Real Life Twitter (E-Guiders)

- Microsoft's Ozzie On Web Strategy & the Next Big Thing In Tech. (Forbes)

- Shorter URLs Provide Real Value and Make Tracking Easier (NYTimes)

- Publishers Nurture Rivals To Kindle (WSJ)

- More Posts with Lighter Ideas and Fun Links.

You make a really good point with your Elliott Wave chart. Almost everyone in the Elliott Wave community has labeled this move up as primary wave II up, expecting a 50% retracement of the entire move up so far.

Your chart has Wave 4 as a regular flat, which, as a “sideways” pattern, would alternate with the sharp move up in wave 2. Also, wave 4 looks about right timewise (usually longer than wave 2) and fits the Wave 4 psychological pattern of a false bottom. If it stops here, it would also follow the typical target of wave 4 of the previous 3. This still seems like the most likely outcome to me.

The other side of this is that if you look at the S&P and assume the wave patterns are in sync, wave B of 4 dropped way below the start of wave A. This is possible in a very rare pattern called a running flat. If this wave in Wave C overshoots Wave A (943.85)in the S&P, it can’t be a running flat, and must be something else. We are currently filling an open gap in the S&P that goes up to 934.7, and if we bounce off of that, it would definitely fit the pattern. A wave 5 divergence between the Nasdaq and S&P is very possible, but the Nasdaq will almost always lead the S&P, so having the S&P start primary II first is really unlikely. I’d really like to see a chart of S&P minus the financials to see if that’s the cause of the really low wave B, and I’m wondering if this is something I can cook up in Think Or Swim.

Most of the European indices are showing much cleaner Elliott Counts for this move up, and most of them are showing corrective (A-B-C) counts. Also, dividing the US indices by UUP (the dollar bullish fund) yields something that looks more like an A-B-C correction than five waves up.

Of course, if it is a wave II, the most common pattern would be a ZigZag going up to S&P 1050. I’m seeing divergences everywhere, including that leading sectors (the NDX and the IYR) didn’t follow the S&P to new highs after May 7th. I’d expect wave B of the Zigzag to take us to 800 if this is the case before a rocket shot to 1050, followed by armageddon.

It will be really interesting to see where this goes, especially with the S&P so close to the running flat line in the sand.