A good magician misdirects your focus with clever patter, distracting gestures and a pretty assistant. Why does that remind me about the current state of market perception and the economy?

A good magician misdirects your focus with clever patter, distracting gestures and a pretty assistant. Why does that remind me about the current state of market perception and the economy?

Perhaps in part because of the rosy picture the recent rally paints, while few notice the plunge in S&P 500 earnings. That means the great bargain you think you are buying isn't such a bargain.

Stocks Are Expensive Again.

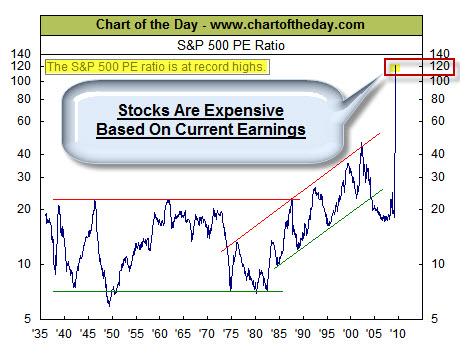

The chart below, from Chart of the Day, illustrates how this plunge in earnings has impacted the current valuation of the stock market as measured by the price to earnings ratio (PE ratio).

Generally speaking, when the PE ratio is high, stocks are considered to be expensive. When the PE ratio is low, stocks are considered to be inexpensive. From 1936 into the late 1980s, the PE ratio tended to peak in the low 20s (red line) and trough somewhere around seven (green line). The price investors were willing to pay for a dollar of earnings increased during the dot-com boom (late 1990s) and the dot-com bust (early 2000s).

As a result of the current plunge in earnings and the recent 2.5 month stock market rally, the PE ratio has spiked to the low 120s – a record high.

Click here for a different perspective on this chart.

Precious Metals Are Performing Well.

At the same time, there is another trend worth watching. Money is moving to gold.

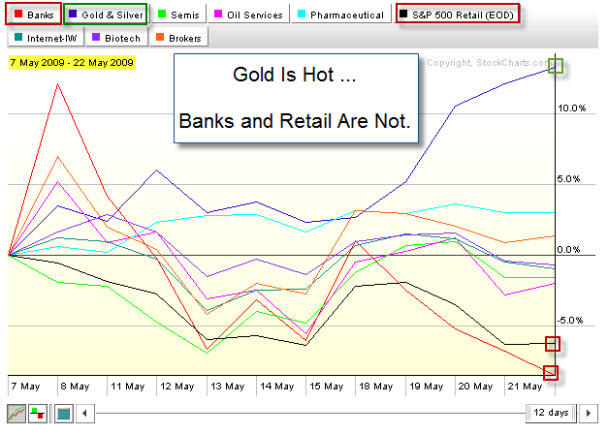

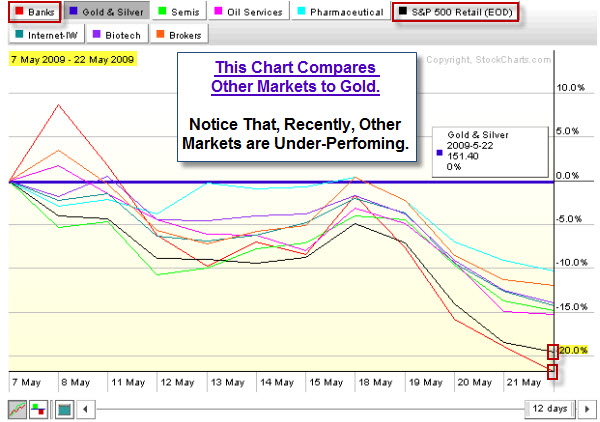

The chart displays the relative performance of several market sectors over the past few weeks. The chart below shows the same data, but compared to Gold as the baseline. It highlights how dramatically the other markets have under-performed recently.

The recent financial crisis has clearly re-ignited investor interest in precious metals. Many believe that gold and silver are good bets during tough times – and a hedge against inflation. So it doesn't surprise me that I'm hearing more investors using Warehouse Depositary Receipts to actually take delivery of the asset rather than just speculating.

What To Expect.

A short-term bounce wouldn't surprise me here. The markets have held-up fairly well after the big rally. So another test higher makes sense. However, based on the weakening internals, the intermediate-term outlook is looking more bearish to me.

Business Posts Moving the Markets that I Found Interesting This Week:

- Will the Fed's Medicine have Inflationary Side-Effects? (WSJ)

- Treasury's Next Phase Of Bank Rescue: Buying Toxic Assets. (Dealbook NYTimes)

- Two Tech IPOs This Week: Is The Dry Spell Over? (NYTimes)

- Financiers In China Are Getting Leery Of Dollars & Are Accumulating Gold. (Forbes)

- Russians Offers to Invest $200 Million in Facebook at $10 Billion valuation. (WSJ)

- Despite Russia's Struggling Economy, Its Market Surges. (NYTimes)

- Is A Low VIX Good? Not In My Experience. Who's Afraid Of the Bear? (Money)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- How Well Can You Live In India On $2 Per Day? (Slate)

- Verne Harnish Insights & Best Practices for Growing Leaders and Companies. (Blog)

- In Praise of Dullness: the CEO Traits That Most Help Them Thrive. (NYTimes)

- When Will Computer Intelligence Surpass Our Own? (NYTimes)

- IBM Unveils Software to Find Trends in Vast Data Sets. (NYTimes)

- Kindle Books Now Account for 35% of Sales When Available. (Business Insider)

- Why Predictions Based On Search Were Wrong About 'Idol' Winner. (MediaPost)

- More Posts with Lighter Ideas and Fun Links.