Declaring Victory Over the Financial Crisis?

Declaring Victory Over the Financial Crisis?

This week's news brought President Obama declaring: "We have stopped the free-fall. The market's up and the financial system is no longer on the verge of collapse. … So there's no doubt that things have gotten better." Obama also defended the bailout of the banks as a necessary measure to hold-off greater financial trouble; explaining that he inherited "the worst economy of our lifetimes." That's all well and good; yet, it reminds me of a different President who declared "mission accomplished" … just a tad too quickly. Time will tell. I just hope we keep making progress.

The Markets Have Done Well Recently.

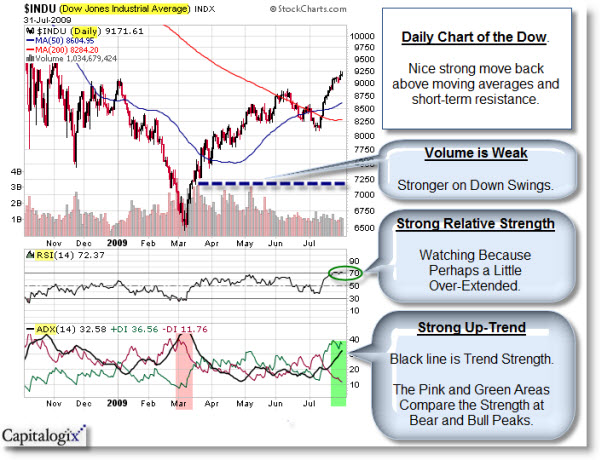

During the last three weeks, the S&P 500 climbed more than 10% higher on better than expected earnings. So far over 70% of companies have beat earnings estimates. The Dow Jones Industrial Average Index is strong too. Here is a chart showing recent performance.

What is Driving the Rally?

Sentiment is driving the markets higher. But, does it worry you the earnings picture isn’t actually improving? How about that the defensive posturing by corporations evidenced by massive cost-cutting is not true organic income statement improvement? It’s certainly not sustainable, and it’s only questionably good news. Still, the market has continued to respond bullishly to “better than expected”. This is similar to celebrating that the economy and consumer spending are shrinking … but less than expected.

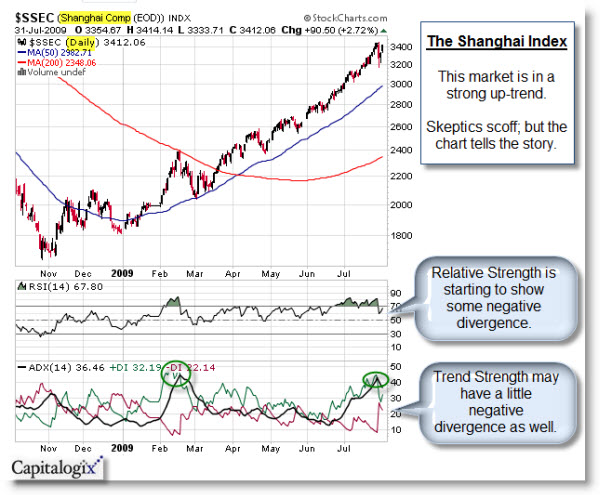

Markets can continue to rally in the face of logical questions about its true strength. For proof, you can look at the following chart of Shanghai's market, which many skeptics believe is a bubble waiting to pop.

So, are we really in a new bull market? Or is this prolonged rally a massive trap, sucking-people-in, only to collapse back down? In my opinion, it doesn't matter. Despite what we call it, whatever will be, will be. What matters is how you trade it.

Business Posts Moving the Markets that I Found Interesting This Week:

- Major Dow Theory Buy Signal; But Should You Take It? (Barrons)

- Triggering an S&P 500 Buy Signal That’s Worked Since 1950’s. (Traders Narrative)

- Ned Davis' Seven Factors to Determine a Secular vs. Cyclical Bull Market. (Ritholtz)

- Some Promising Signs for the Economy and the Equity Market. (Dash of Insight)

- CNBC Viewership Down 28%. Does that say something about the Market? (ZeroHedge)

- "Cash for Clunkers" May Cost Up to $45,354 Per Vehicle. (Seeking Alpha)

- High-Frequency Trading: A Good explanation of the Core Issues. (WSJ & NYTimes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Flipping Out – Think a Coin Toss has a 50-50 Chance? Think again. (Big Money)

- Wriston’s Law: Capital Goes Where it's Wanted, Stays Where it's Well-Treated. (Forbes)

- Obama Chia Pet – Determined Pose. Truth is so much funnier than fiction. (Drugstore.com)

- A Better Way to Rank Expertise Online. (Technology Review)

- Things to Call Your Robot When You're Angry at It: from "Lost in Space". (PromisedPlanet)

- Finding New Ways to Shoot Down Spam. (Technology Review)

- Proof I'll Do Anything to Win a Bet. (YouTube)

- More Posts with Lighter Ideas and Fun Links.