Traders are starting to sell into strength. That is something to watch.

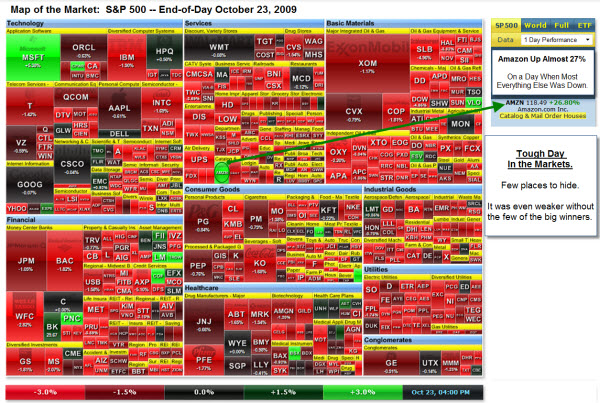

This Heat Map, from FinViz, shows that last Friday was a tough day in the markets. Most everything was red. However, Amazon was up almost 27%. And Microsoft had a pretty good day too. Realize that the averages would have been even weaker without those outlier performances.

But big up-moves on big down days are another sign of volatility, confusion and disagreement. These are simply things I've learned to notice.

Price is still the primary indicator. So keep an eye on the trend-line of your choice.

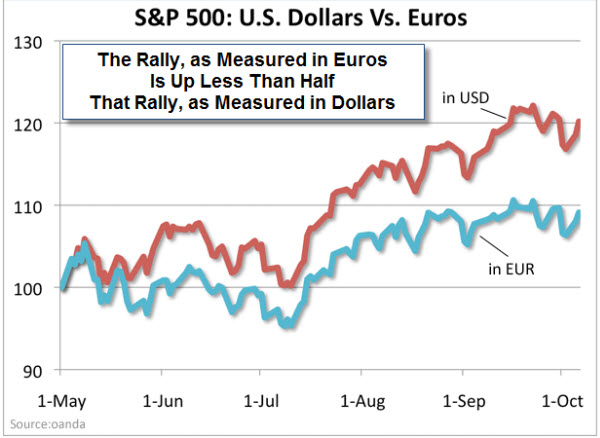

Items In the Rear-View Mirror May Only Be Half as Big as They Seemed.

Why isn't the world beating a path to our markets, driving-up prices and volume? Perhaps because they don't see our market the same way we do.

This next chart caught my eye because it shows our 20% rally (since May) is less than a 10% rally, when it is measured in Euros instead of Dollars.

A similar phenomena is playing-out with Gold too.

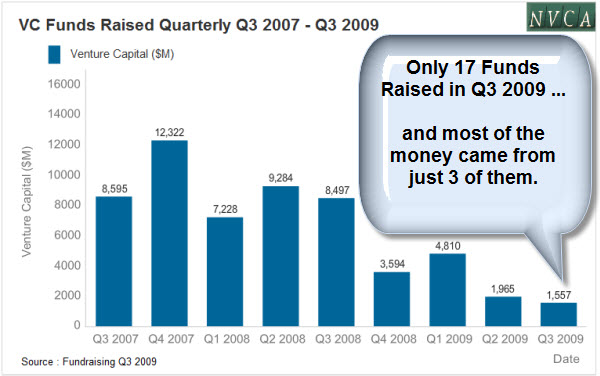

Venture Capital Charts are Eye-Opening … But Not Wallet-Opening.

The third quarter was rough for VCs, with 17 firms raising just $1.6 billion. That's the fewest number of firms to raise money in 15 years; and it's the smallest amount of money raised since Q1 2003, says the National Venture Capital Association.

How tough was it? Venture Capital funding fell 42% through the third quarter compared with last year, and had an 81% drop quarter-to-quarter from a year ago.

The more I think about this, the less it worries me. There is a lot of money sitting on the sidelines, and I believe that we just aren't in the stage of the cycle where late-majority money flows to speculative investments. There is a similar situation going on in the M&A cycle too.

When the longer-term economic recovery gets moving, so will the money.

The Jobs Flu.

The real virus affecting the economy is unemployment.

For example, Sun says it is about to cut 3,000 jobs. Frankly, I hear chatter from a number of companies planning to reduce headcount in meaningful and painful ways. Bottom Line: Without a clear path to more sales, the pressure to make numbers is driving further reductions.

It seems several things are thinning the workforce.

President Obama declared swine flu a national emergency. Officials described the move as similar to a declaration ahead of a hurricane making landfall; though perhaps it was more a "call to action," like how they hand out Nobel Peace Prizes.

Business Posts Moving the Markets that I Found Interesting This Week:

- What Happens When the Fed's Buying Binge Ends? (WSJ)

- McKinsey Says Global Capital Markets Entering a New Era (McKinsey)

- Sharp Drop in Start-Ups Bodes Ill for Jobs & Growth Outlook. (WSJ)

- Bank of America Lost $1 Billion in Q3, & It's Now Testing Support. (NYTimes)

- Great Chart of Google's Long Road Back To $500 (BusinessInsider)

- Nokia Slaps Apple with Lawsuit about Wireless Patents. (Forbes)

- Some Reasons Not to Care about Dow 10K. (CuriousCapitalist)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- A $1 Million Research Bargain for Netflix, & Maybe a Model for Others. (NYTimes)

- Forbes Lists the 50 Most Influential Management Gurus. (Forbes)

- Does Social Media Mark the End of the Email Era? (WSJ)

- 54% of CIOs Forbid Use of Social Networks at Their Companies. (WallSt&Tech)

- Gout: The Missing Chapter from Good Calories, Bad Calories. (Ferriss)

- Study – Touch Money And You Feel Less Pain. (CreditCards)

- Disney Offers Refunds on Baby Einstein. (TDB)

- More Posts with Lighter Ideas and Fun Links.