Obama's China Visit.

President Obama asked for patience about the economy. Nonetheless, a Gallup poll showed his job approval rating had dropped to 49 percent, the first time he has fallen below 50 percent in this survey, as Americans express dissatisfaction with his handling of the economy and other issues.

Unfortunately for him (and us) that wasn't the only voice of dissatisfaction he's heard lately.

Also, here is a skit from Saturday Night Live. Like most good humor, it is funny because of how much is true. I'm not posting it for partisan reasons … rather, it made me laugh. Hope you enjoy it too.

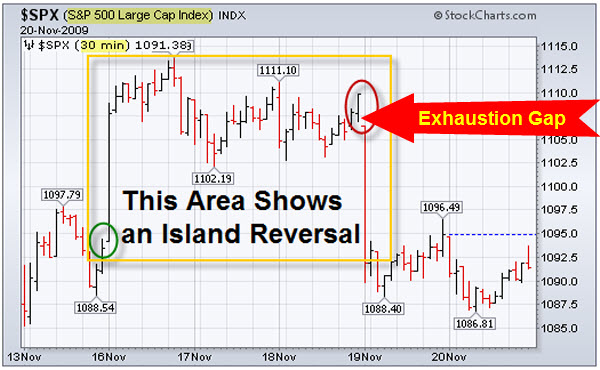

Market Commentary: Spotting an Island Reveal Pattern.

In general, the markets held-up again this week. As I scan the charts, there is little new or opinion-changing information. However, I spotted an Island Reversal pattern on an intra-day chart of the S&P 500. This is often seen at market tops. It starts with a break-away gap (shown by the green circle) and ends with an exhaustion gap (shown by the red circle and the big red arrow).

To understand this pattern, you can think of it as the last buyers rushing to get in (pushing-up price so fast that it creates a break-away gap), only to find that there are no new buyers (causing a price drop and the resulting exhaustion gap). This gap down can signal the beginning of a change in trend.

In this particular case, we are coming into a holiday-shortened week (often characterized by light trading). So I'm not expecting anything dramatic. Still, it seems worth watching to see if the market trades back up above the exhaustion gap.

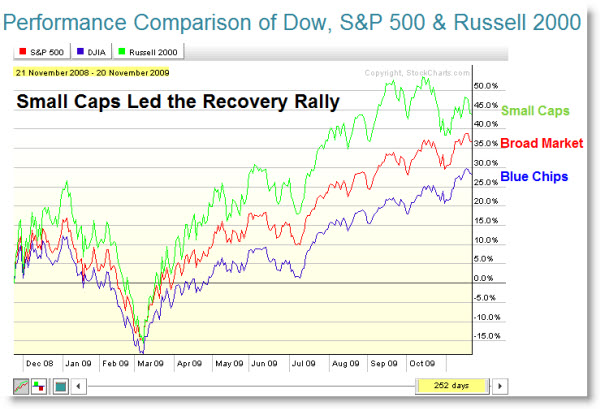

Something Changed: Small Caps and Techs are Not Leading The Way.

Here is something else that caught my eye. The chart below shows that the Russell 2000 Index (shown in green below) has led the way throughout the recent rally. The S&P 500 Index (shown in red below), represents the broader market. While the Dow Jones Industrial Average (shown in blue below) lagged. You can click the chart image below to launch an interactive version on Stockcharts.com. This chart shows the relative performance of these indices during the past year. You can adjust the date range by dragging the date bar at the bottom.

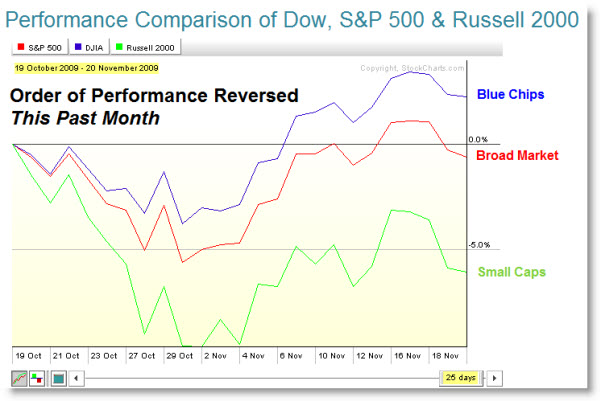

The next chart shows the same information, except limited to the past month. Notice that the relative performance of these indices has reversed.

I'm watching this rotation to see if small caps recover or continue to show weakness. They could be the canary in the coal-mine for a bigger correction.

Business Posts Moving the Markets that I Found Interesting This Week:

- Fed Eyes Dollar Drop, But Clings to Low-Rate Pledge. (FluentNews)

- Goldman Outlines Fed’s New Dashboard Indicators. (WSJ)

- Buffett Says His Businesses Have Bottomed (Reuters)

- Memo to Buffett: Put Down the Pom-Poms & Tell Us the Truth. (HuffingtonPost)

- New Market Bubble is Brewing: It's Déja Vu All Over Again. (Newsweek)

- While U.S. Economy Struggles, China's Rises. (NPR)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Is Too Much Science Thwarting American Innovation? (FastCompany)

- 15 Google Interview Questions. Answers at the End. (BusinessInsider)

- How Ritz-Carlton Stays At The Top. Interesting. (Forbes)

- Twitter: People Tweet 27 Million Times a Day. (HuffingtonPost)

- Let Them Eat Dog. (WSJ)

- Forbes Blog Post on How Leaders Balance Urgency & Patience. (Forbes)

- More Posts with Lighter Ideas and Fun Links.

Howard,

Without qualification or reservation your comments this week are definitely cautious to bearish and we are in the same camp. Somewhere out there is a great bull market that will take all stocks to the moon so we are all hoping for better prices to enter this market with less risk.

In answer to the comedic question of how to pay back the Chinese, I have devised a modest proposal for the repayment. We can simply cede sovereign ownership of North Dakota in exchange for an amount equal to our entire national debt. No one except Harley riders will miss North Dakota. The only things that come out of North Dakota are inept reactionary politicos.

This transaction is not without precedent. During the American Revolutionary War, John Adams, as ambassador to France, arranged a loan to the colonies from a syndicate of banks in Holland. In 1791 George Washington ceded ownership of several million acres of land in upper New York State along the Mohawk River to those very same Dutch banks and thus the debt was repaid. The Dutch banks divided the land into 600 acre plots and sold off the farmland over the next 90 years.

If North Dakota won’t work then we can always try New Jersey.

In closing, college kids are so creative!

DC

Your “Island Reversal”, when viewed in a different time dimension, the Daily S&P candlestick charts, are are manifested as two classic reversal patterns, a Hanging Man followed by an Evening Dolji Star. Their very names are onomatopoetic to their meaning. These candlestick formations will most always be found at the end of a trend and the beginning of a reversal.

DC