We Do Live In Interesting Times.

The markets pulled-back a little last week. To be fair, the correction was small in comparison to the size of the rally since last March. In many cases where the recent trend has been bullish for so long, people use this type of weakness to add to positions. So, an oversold-rally would make sense here.

However, some traders have doubts about the health of the market.

There is a fear that things may not be what they seem. For example, the GDP number came in higher than expected, but still resulted in selling. OK, GDP didn't tell us useful things (this time) because the better than expected number was the result of accounting and statistics, rather than real economic growth. Traders saw through that, and also see that there are still troubling data points coming in … like that Durable Goods Orders and Weekly Unemployment Claims were both weaker than

expected; and Consumer Spending continues to decline. Still, the Markets sold "good news" again last week. And even

though the moves weren't violent or extended, I take that as a bearish

indicator.

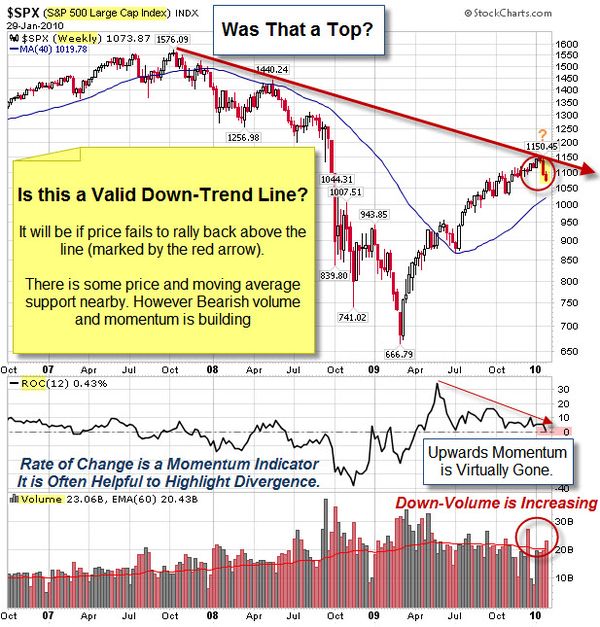

Is It Possible That the Market is Still in a Down-Trend?

Right now, the issue is whether price can get back above the down-trend line (marked by the red arrow) that started in October of 2007.

Is that down-trend line really valid? It will be if price fails to rally here.

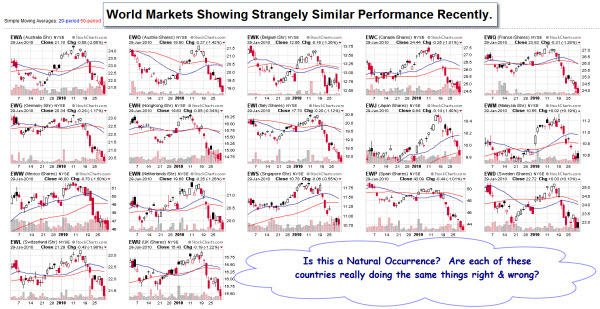

As you examine the markets, it is easy to become near-sighted. By that I mean that it is easy to look at the ups and the downs, and to assign a cause based on what's happening in America (for example, the crisis of faith in Bernanke, Geithner, or even a jobless recovery). However, it is harder to believe that any of those issues is the real cause after you look at the next chart (or collection of charts).

How Can The Economies Of This

Many Countries React the Same?

A quick glance around the globe shows remarkably similar performance in many markets.

It brings up two questions:

- Are each of these countries really doing the same things right and wrong?

- Are world-wide expectations and responses really this similar?

To get a closer look for yourself, here is a link to the charts. That brings up a third question: What's really causing the markets to behave so similarly?

HBR Shows that Countries Did Deal With the Crisis Differently.

The economic crisis will influence business long into recovery. This Harvard Business Review visualization puts various bailout and stimulus programs in perspective. Calculating these interventions as percentages of GDP helps identify which economies will be stressed and which will have the resources to bounce back.

Is This Time Different?

Lots of people are reading Reinhart & Rogoff's book, This Time is Different. It examines the trend towards public debt that balloons in

response to financial crises. Here is an excerpt from PIMCO's summary of the book:

- The true legacy of banking crises is greater public indebtedness, far beyond

the direct headline costs of bailout packages. On average a country’s

outstanding debt nearly doubles within three years following the crisis. - The aftermath of banking crises is associated with an average increase of

seven percentage points in the unemployment rate, which remains elevated for

five years. - Once a country’s public debt exceeds 90% of GDP, its economic growth rate

slows by 1%.

These examples tend to confirm that banking crises are

followed by a de-leveraging of the private sector accompanied by a substitution

and escalation of government debt, which in turn slows economic growth and

(perhaps) lowers returns on investment and financial assets.

Business Posts Moving the Markets that I Found Interesting This Week:

- The Ups & Downs of Obama's 1st Year. How Did He Do? (CNN)

- Did the State of the Union Address Actually Change Anyone's Mind? (Slate)

- IMF Sharply Raises Global Economic Growth Forecast in Developing Countries. (Reuters)

- Is the Worst Yet to Come in VC? The Strong Will Survive. (WSJ)

- AT&T Reports 2.7MM New Wireless Users & is iPad's Sole US Data Carrier. (Forbes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Pope and Social Media: Give Us This Day Thy Daily Post. (NPR)

- How Technology Enhances Collaboration. (Forbes)

- How the U.S. Enabled the Chinese Hacking of Google. (CNN)

- U.S. Says Free Access to Internet is a Foreign-Policy Priority. (ZDNet)

- Will There be iLust for the Apple's New iPad? (Forbes)

- More Posts with Lighter Ideas and Fun Links.