The markets did rally, a little, last week. However, they are still beneath the overhead resistance and the longer-term downwards sloping trend-line.

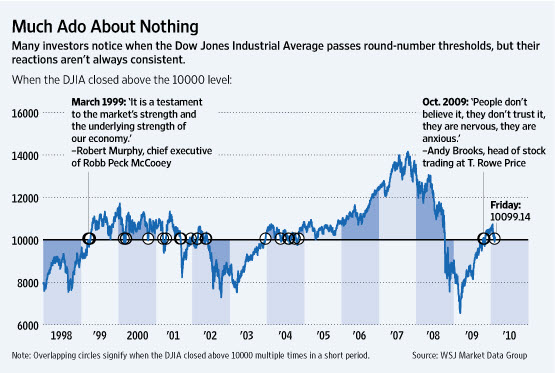

The Dow Jones Industrial Average has been able to hold above the 10,000 level. Is that important?

Does

Dow 10,000 Really Mean Something?

The WSJ published an

article called "Milestone Figures Grab Attention, but Their Impact Is

Hazy". A similar message comes from Barry Ritholtz; that Dow 10,000 has become “a

meaningless number, without any impact technically or quantitatively.

It's no surprise that the Dow did not hold over 10k for very long. It's

been over 26 times, starting in 1999. And hear it is, 10 years later —

zero progress. Why anyone — other than TV producers and silly hat

manufacturers — cares about Dow 10k is quite simply beyond my

comprehension.” If you are curious, here is the chart that shows what that looks like.

If big round numbers don't mean anything, is there something to potentially point the way?

Is Lumber Sending a Bullish Signal About the Broader Market?

If you are looking for a potentially bullish early indicator, then Lumber may be sending you a signal. It has continued higher, even during the recent equity market decline (marked by the orange rectangle). Why do traders consider lumber an early indicator for the broader market? Since lumber is a primary raw material in the early stages of new construction, the logic is that lumber purchases signal new construction.

What Can Copper Tell Us?

Like Lumber, traders also look to Copper as another early indicator of new construction because it commonly used in things like wires and pipes. Recently, several commentators have mentioned that the Copper/Gold Ratio is an interesting composite measure of economic activity. The chart below shows weakness and a negative divergence of the Copper/Gold Ratio (in comparison to the S&P 500 Index) since last summer. Most recently, price has been falling steeply. We will see if that is an early indicator of broader market weakness?

A similar flattening of trading range occurred in the Financial Sector as well.

What Does the Financial Sector Tell Us?

Financials often lead rallies higher. The logic is that banks make more money when they are lending, doing deals, and helping companies go public. The past six months have shown the hesitation investors have to buy into further gains in this sector. However, price is now at the bottom of its six month trading range. In bull markets, this is where the buying comes in. So, let's see how this sector responds. A move down from here would hurt the bullish case.

This is a holiday-shortened options expiration week. Recently, those have been rally triggers. Best wishes for a great week.

Business Posts Moving the Markets that I Found Interesting This Week:

- Google Revenues Reach $1.34 Million Per Employee. (BusinessInsider)

- CME Buys 90 Percent of Dow Jones Index Unit for $607M. (NYTimes)

- The Birth of BRIC & a Few Other Countries to Watch. (SeekingAlpha)

- Does George Soros Think Gold is an Asset Bubble? (Slate)

- Putting Apple's Giant Pile of Cash In Context. (BusinessInsider)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Easy = True: How ‘Cognitive Fluency’ Shapes Our Beliefs &

Investments. (Boston) - New and Easier CPR Technique from Mayo Clinic. (YouTube)

- Google's Experiment: Leapfrogging ISPs to Deliver Ultra-High-Speed

Web

Access. (ZDNet) - Angry at Obama Regulation Proposals, Wall Street is Donating Less to

Democrats. (Newser)

- Clever Questions You Should Ask Every Job Candidate. (BizMore)

- More Posts with Lighter Ideas and Fun Links.