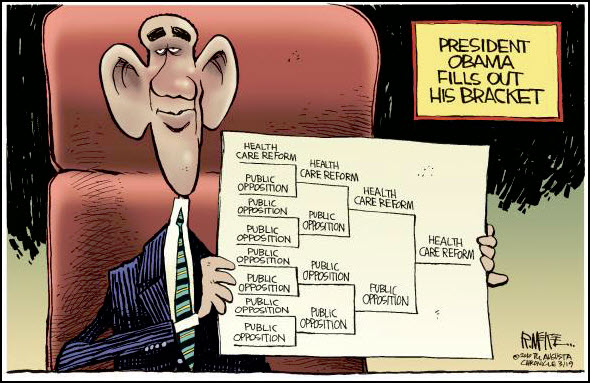

March Madness is in full force. What's a $ Trillion here, or a $ Trillion there?

A Look at the Markets.

Most people consider it "bullish" when markets go up 14 of 16 days. That should make people happy, right?

Recently, though, I've had conversations with several "old-pro" traders who expressed a sense of frustration. They view the recent push higher with skepticism. Trading discipline is allowing them to make money on the upside, but it's not as satisfying as being "right".

What do the Charts Show?

Let's look beyond the obvious up-trend. The following chart and video, from Brian Shannon's Alphatrends site, shows that price is now below the volume-weighted average price paid since Fed Decision to leave rates unchanged.

How Far Can the Rally Go?

On a basic level, the recent market rally shows that there's more buying

demand than selling pressure. However, when there is little selling

pressure, it doesn't take much demand to keep prices going higher.

At this point, the rally has gone on long enough that many of the participants who profited

from the extended move up are now becoming defensive.

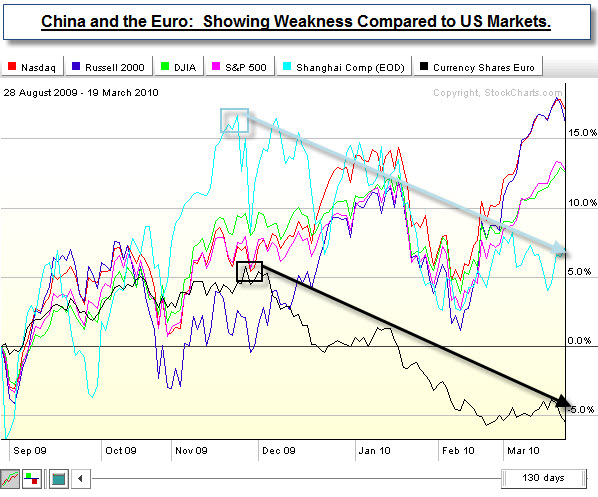

Also, some trading

relationships that tend to move together have decoupled. The following

chart shows the recent weakness of the China Shanghai Index and the Euro

in comparison to the U.S. Markets.

Some see the U.S. Market's continued relative strength as a precursor to a new leg of the bull market, while

others see it as a temporary anomaly.

Adding to the bearish case is that several sentiment indicators show

very little fear. The VIX

is moving back to the extreme levels of complacency. Odd-lot shorts

recorded a 13 week low, indicating that the "little guy" has virtually

given up on shorting. Likewise, the lack of fear is downright scary when

you look at CBOE's

Equity Put-to-Call

Ratio. These readings are contrary indicators, meaning they often occur at

turning points in the market.

And with quad-witching

expiration behind us, and an unpopular health-care issue in

the news, the bears will have another chance to show their conviction … or lack of it.

We'll see what happens. I hope you have a good week.

Business Posts Moving the

Markets that I Found Interesting This Week:

- Nice Overview, Weighing the Decision on Health Legislation. (OldProf)

- Polls Show Only 27% Believe U.S. Heading in Right Direction. (Rasmussen)

- Federal Reserve Faces Challenges and Changes. (Atlantic)

- Pandit Sees Revival of Citi’s Fortunes. (FT)

- What Does the VIX Really Tell Us Here? (Minyanville)

- More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Apple Selling 20,000 iPads Per Hour – that's $10 Million per hour.

(BizInsider) - Microsoft Launching Office 2010 this May. (Infoworld

& ZDNet) - Secret of a Happy Marriage? A Wife 27% Smarter Than Her Husband.

(D-Minds) - How March Madness Breaks Down … Academically? (USNews)

- Were You Born to Be a Billionaire? (Forbes)

- More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=548afa6e-fc1f-471b-840e-9aaf4d28f9f3)