Enticing the Crowd Back to the Markets With "You Can't Win If You Don't Play".

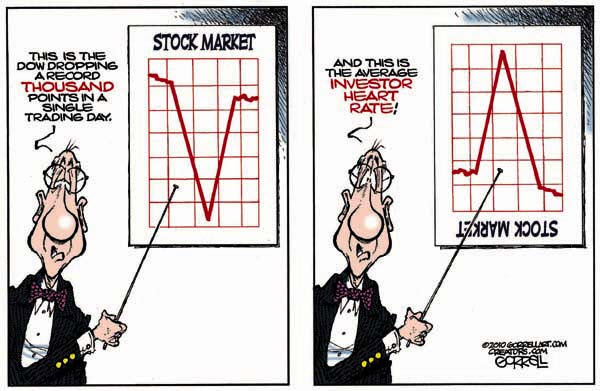

After the "flash crash", the markets recovered quickly and then sold off again, ending that week with additional selling pressure. While some people might have seen that volatile move down as a buying opportunity, many others saw it as a place to get short (or at least to take some risk off the table).

The result was heavier shorts and lighter longs going into the beginning of last week.

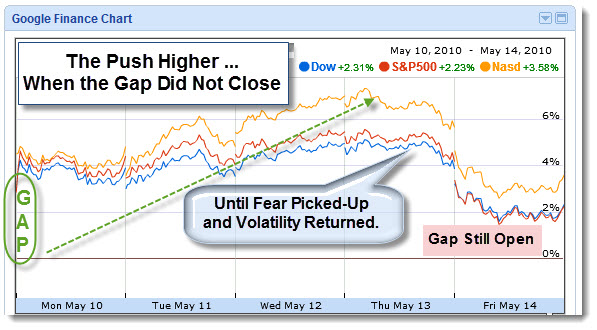

For those of you that believe in the "Plunge Protection Team" (which isn't quite the same as believing in the Tooth Fairy), then it probably wasn't surprising to find the markets gapping higher to start trading last Monday. Nonetheless, you might have been surprised to find that the gap was close to 4%.

It All Depends on How You Look At It.

Once again, different types of traders will interpret that as a threat or an opportunity.

The Bear: Some consider "expecting gaps to close" to be a high probability trading setup. Consequently, a big gap-up offers an opportunity to enter a short position with a well defined stop. Add the increased volatility, and the bears were frothing at the mouth.

The Bull: This type of trader would notice that a 4% gap is very different than a half percent (or a even a one percent) gap. Consequently, they expect massive short covering from all the bears trapped in their short positions from the week before. Therefore, they are looking to buy the gap (instead of shorting it).

Imagine the arguments at trading desks around the world as they try to figure out whether this pattern was part of a market top or the sign of a continuation rally.

Obviously, the markets continued higher. This forced more shorts to

cover, and also disturbed traders who wanted to buy, but didn't because

of risk concerns.

The Skeptic: That brings up a third type of trader, someone who was sitting on cash because their trading systems work well during normal market conditions (but who suspects that these are not normal market conditions because of the volatility and exogenous threats).

So, Wednesday comes and it is clear that the markets have been trending higher. Now imagine the conversations at the trading desks of the people who are sitting-out these big swings. They are getting pressure from their bosses and their clients to ask why they are missing these "easy" trades.

It's easy to go to cash, but when do you get back in? How do you determine when it's safe to get back in the water?

Is It Safe?

And there are signs that something "different" is happening. Here is a video from Jason Leavitt.

Learned

Behavior.

Many of the algorithmic firms got burned

during the last period of unusual volatility. They have the benefit of

sophisticated back testing and analysis tools. You'd expect them to

develop new rules to reduce their exposure, or at least a switch which

systems are using in the markets. So their behavior shouldn't be surprising.

Pick Your Poison.

Going back to the folks who believe in the Plunge Protection Team, as I've discussed before, it makes sense for the government to move the markets higher during periods of light trading. It accomplishes their goal with the least cost.

Because it's supposedly a free market, if people disagree with higher prices … it will trigger selling. At this point, it appears that we are getting close to the area that will trigger selling. Moreover, I don't think it is in the government's interest to prevent that from happening. Nonetheless, there is a lot of backstage maneuvering going on right now to prevent heavy selling.

So traders now have a different decision in front of them. On one hand, they know it isn't often profitable to fight the Fed. On the other hand, in the long run, it's even harder to fight human nature. Markets can be pushed a little this way or that; but for how long?

And our government isn't the only one facing tough choices.

Greece Is The Word, At Least For A Little Longer … Then It Might Be PIIGS.

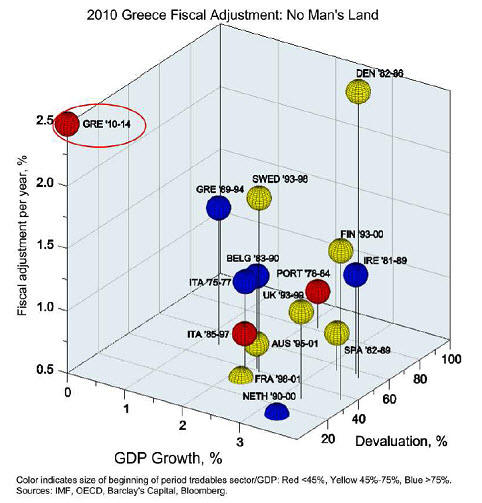

Paul

Kedrosky posted a chart showing that this time is different.

Behold the immensity and the singularity of Greece’s sovereign debt

& fiscal adjustments.

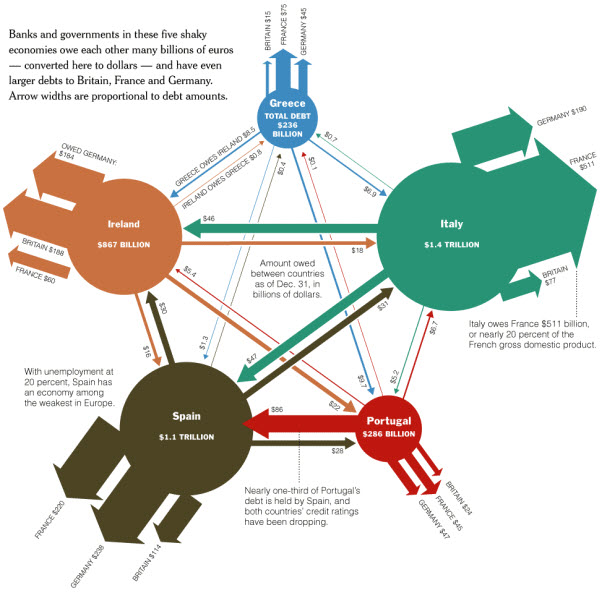

Next, take a look at this. The NYTimes came up with an interesting graphic depicting Europe's web of debt.

As the Atlantic

points out, it's not just the case that these countries are running

huge deficits. It's also worrying that they owe each other tens of

billions of dollars. Greece owes $10 billion to Portugal. Portugal owes

$86 billion to Spain. Spain owes more than $200 billion to both France

and Germany. If Greece defaults, it's not clear where the domino effect

stops.

Business Posts Moving the

Markets that I Found Interesting This Week:

- The Invisible Sledgehammer: The Effects of Computer Trading. (MarketWatch)

- Are Fundamentals about to Overtake Momentum? (InvestmentNews)

- ETFs Lose Way In a Panicked Market: 68% of Canceled Trades Involved

ETFs. (WSJ) - Did a Big Bet Help Trigger the "Black Swan" Stock Swoon? (WSJ)

- SEC Gave Exchanges 24 Hours to Devise New Trading Rules to Avoid

Another Plunge. (WP) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Octopus vs. Shark: One Way to Deal with a Threat is to Eliminate It.

(Newser)

- Your Office Chair Might Be Killing You … or at Least Affecting

Your

Health. (BizWeek) - iPhone Raid: Blurring the Line of Law Enforcement Versus Corporate

Tool.

(LATimes) - Russian Official Says He Spoke with Aliens – Triggers Security

Inquiry.

(Newser) - Google Tool Reveals Governments' Hunger For Data. (InfoWeek)

- More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=5e97204e-e26c-47ac-bf0d-b9d75a987cb4)