Initial Public Offerings are an indicator of market health. We got an interesting look through the IPO window last week, with six offerings.

Initial Public Offerings are an indicator of market health. We got an interesting look through the IPO window last week, with six offerings.

While some were weak, the long-awaited stock market debut of the Chicago Board Options

Exchange had a strong opening reception.

In general, though, it has been a tough market for IPOs. However, the WSJ argues that this has more to do with fundamentals of the deals than a weak market.

So, how is the market doing?

Fighting the 200-Day Moving Average.

Even people who are not big fans of technical analysis tend to look at the market's 200-day moving average. This is the simply the average of the closes for the previous 200 days. The 200 DMA has a decent track record — when the market is above the 200 DMA, it tends to rally, below it, not so much.

In the daily chart of the S&P 500 Index, below, the 200 DMA is drawn as a red line. The recent trades, back above the 200 DMA line, are circled in green with a yellow highlight.

In the past few weks, the S&P 500 has tried to break out above its 200 DMA several times, but each attempt has sputtered out. Let's see if it holds this time?

There are a few other bullish reasons for it to hold. The market has stayed above the light green 1040 support level, despite three tests (marked by the orange circles). The last two tests count as a double-bottom, which indicates a bullish reversal (especially with price back above the orange-dashed down-trend line and 200 DMA).

Sentiment towards the U.S. Markets is also getting better.

The Pendulum Swings: Investors Starting to Pick U.S. Over BRICs.

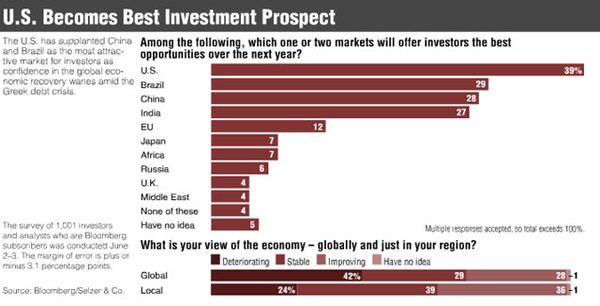

Bloomberg reports that the U.S. has supplanted China and Brazil as the most attractive market for investors as confidence in the global economic recovery wanes in the wake of the Greek debt crisis.

Almost four of 10 respondents picked the U.S. as the market presenting the best opportunities in the year ahead. That’s more than double the portion who said so last October.

Business Posts Moving the

Markets that I Found Interesting This Week:

- Six Giant Banks Made $51 Billion Last Year; The Other 980 Lost

Money. (Forbes) - Apple Reports 600,000 Orders for New iPhone On First Day. (NYTimes)

- The Pain in Spain: On the Brink of Seeking Support From The

Euro-Zone & IMF. (WSJ) - Trading Is Approved for Film Futures Contracts. (NYTimes)

- State Crash Crunch: Arizona Sells Supreme Court Building for 3

Month's Relief. (GEA) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- I.B.M.'s Watson Supercomputer – Artificial Intelligence Smarter Than

You Think. (NYTimes) - Interactive Map Shows Where Americans Are Moving. Hint: Not to

Detroit. (Forbes) - Obama's West Point Speech – Parsing the New Security Strategy. (Atlantic)

- Things People Google When They Think Nobody Is Looking. Funny. (SEOLOL)

- U.S. Identifies Vast Riches of Minerals in Afghanistan. (NYTimes)

- More

Posts with Lighter Ideas and Fun Links.

Apple again put new product on the front pages in the newspapers.

http://www.viewheadlines.com/Technology/Article.aspx?i=16651&t=Video-iPhone-4-First-Look