The fear, right now, is whether the recent down-turn will continue. Meanwhile, there are signs of strength giving hope to the bulls.

For example, disappointing U.S. retail sales data, last Friday, failed to dent the stock market as it closed higher on the day and the week. That marks the first weekly gain in nearly a month.

Last week's market action sets-up some pretty clear decision-zones to watch.

First, Let's Look at the Dow.

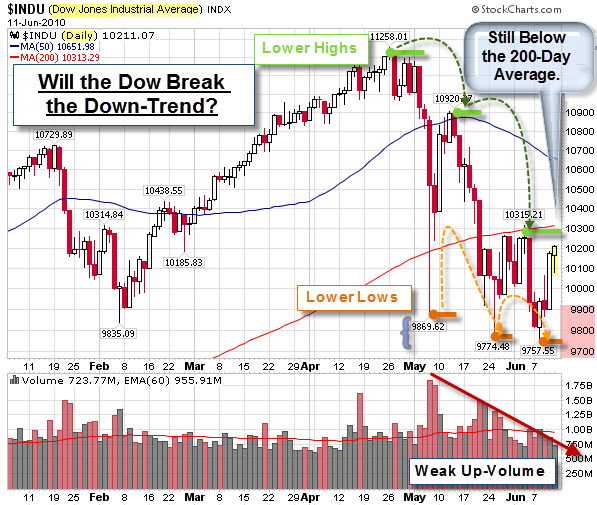

Despite the recent market correction and fears surrounding Eurozone sovereign debt defaults, the bottom line is that the Dow Jones Industrial Average is only down 10% from its recent peak. That is not bad, especially considering the length of the preceding rally.

However, a quick look at the chart shows a series of lower highs and lower lows. This is the classic definition of a down-trend. Two other bearish things to notice are that price is still under its 200-Day Moving Average and that volume has been weaker on the recent up days.

On a bullish note, the Dow spent a good day-and-a-half below the 9,900 level, yet, sellers did not appear in force … and buyers once again prevailed. Analysts are likely to see a sustained break above the 10,300 level as a bullish sign.

RSI Indicates That We Are Still in Bearish Territory for the S&P 500, as well.

A chart of the S&P 500 ETF indicates that we may have some upside left in the recent bounce. While the Relative Strength Index indicator remains bearish below its center-line for the SPY, it is close to turning positive.

According to Arthur Hill at StockCharts.com, bounded momentum oscillators trade within a defined range. RSI trades between zero and one hundred, with fifty as the center-line. Think of this level as the 50 yard line in a football game. The bulls (offense) have the edge when RSI is above 50. The bears (defense) have the edge as long as RSI is below 50.

In the chart, below, the yellow areas show periods with RSI below 50, which correspond with declines. RSI met resistance near 50 during each decline (red arrows). In fact, RSI met resistance near 50 twice during the current decline, and it is at that level again.

So, while momentum remains bearish as long as RSI is below 50, this

chart

shows we are approaching a decision point.

What Does the Extreme Fear Shown by Option Purchasers Mean for the Market?

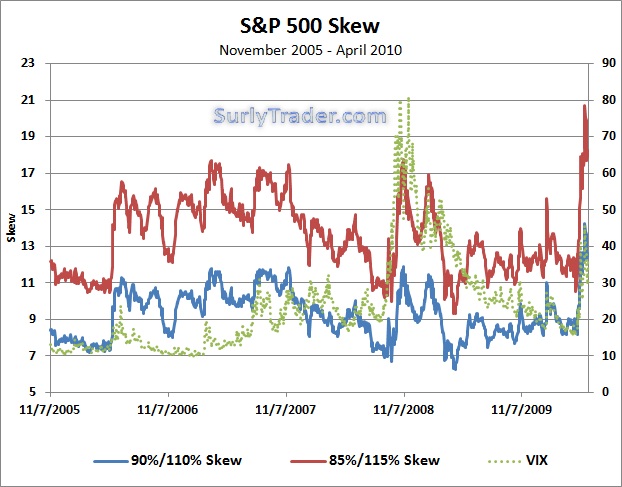

The public often uses the VIX as the standard measure of “fear” in the overall market. Some prefer to look at option skew instead. Skew tells the investor how much out-of-the money puts are being bid up versus out-of-the money calls.

If an investor is scared about the downside, then they buys puts. If an investor thinks there is room for upside, then they are willing to buy calls. SurlyTrader posits that when the difference between the implied volatility of OTM puts dwarves OTM calls, then investors are fleeing for the exits. As the chart below shows, on May 20, 2010, the skew of 3-month options hit a five-year-high.

Depending upon valuations and underlying market conditions, the skew can signal either prescient fear or undue panic. Consequently, if the spike on May 20th is a positive signal, then we should soon find our own local bottom.

SurlyTrader advises: "If you believe we are close to a bottom, selling OTM puts and buying OTM calls looks very attractive with a steep skew. Always think about selling insurance when the building is on fire rather than buying insurance after the major damage has already taken place."

Business Posts Moving the

Markets that I Found Interesting This Week:

- CEOs Made 11% Less in 2009; But Are Riches Ahead Because of Cheap

Options? (LATimes) - Metal Mania Hits Mining Equipment – Many Models Sold Out Until Next

Year. (Money) - Why is Europe Responding So Timidly to Its Economic Crisis? (Slate)

- Germany's 'Desperate' Short Ban Triggers Capital Flight. (Telegraph)

- Inflation in the U.S. Slides to its Lowest Level in 44 years. (WSJ)

- More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- The Forty Best Business Books Since January 2009. (ToddSattersten)

- What Cave Men Understood about Risk and Stone Age Economics? (PsyFiTec)

- Cyberwarfare – Virtual Attacks Could Come From Anywhere. (SingularityHub)

- Bush Defends Water-Boarding. What do you think? (Slate)

- URLs Gone Hilariously Wrong – The funniest web addresses. (Newser)

- More

Posts with Lighter Ideas and Fun Links.