The government's latest snapshot of the job market was bleak, with 14.6 million Americans still searching for work. The disappointment is not limited to July; the report also included unfavorable revisions to data released in previous months. It is becoming clear that the existing policy mix is not appropriate for the task at hand.

Even though we've heard bad news, the market has continued to hold up well. And that is a decidedly bullish sign. There are also a number of positive signs of market strength (like strong breadth, increased corporate spending, and lots of capital on the sidelines ready to be deployed).

Market Commentary: Let's Look Under the Covers.

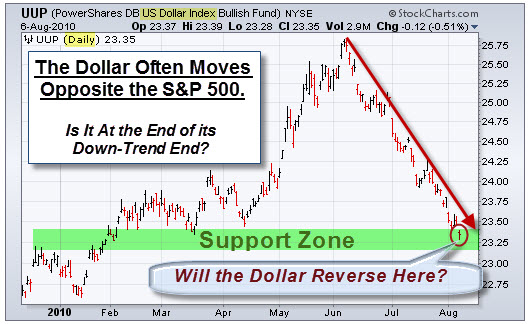

The charts show a few challenges ahead, however. First, the S&P 500 Index is sitting at a resistance zone in a rising wedge pattern. From a technical analysis perspective, that pattern is often bearish (or the place traders look for a reversal).

Bulls are looking for a sustained move above the 1140 level to make them comfortable.

Second, the Dollar looks like it might be at a support level. Will it reverse here? These two markets often move counter to each other. So, having the Dollar at "support" while the S&P 500 Index is at "resistance" might increase the odds of a market turn here.

Just something to keep your eye on.

Finally, this is from late May; but it is making the rounds again … and I thought it was worth sharing.

Steve Wynn Is Not a Shy Man With Few Opinions.

In this video, Steve Wynn (a casino resort/real-estate developer who has been credited with spearheading the dramatic resurgence and expansion of the Las Vegas Strip) calls out the White House and talks about the Fall of America. Interesting perspective from a billionaire.

Business Posts Moving the Markets that I Found Interesting This Week:

- Newsweek Sells For $1 To 92-Year Old Stereo Equipment Mogul Sidney Harman. (BizInsider)

- Cheap Money: IBM Just Borrowed $1.5B at 1%, Via a Three-Year Bond. (WSJ)

- Do Bond Yields Below 3% Signal a Double-Dip Coming? (Economist)

- Sobering Stats: What Are the Odds That the Economy Is In Good Shape? (Insider)

- For Fed, No Easy Answers in Easy Money. (WSJ)

Lighter Ideas and Fun Links that I Found Interesting This Week

- Former CIA Chief Says U.S. Strike on Iran More Likely Than Ever. (Slate)

- Who Knew? Merriam-Webster Ask the Editor Video on the Plural of Octopus. (MW)

- The Google Wave Shut-Down Decision Shows Strong Innovation Management. (HBR)

- Superman Saves Family From Foreclosure – After Homeowners Find $250K Comic (Newser)

- Food For Thought: Meat-Based Diet Made Us Smarter. (NPR)