Why Do the Big Gains Come on Monday Mornings?

Bespoke posted an interesting piece that points out that much of the market gains this year occurred on Monday morning gaps. Since the start of the year, there have been 11 times that the S&P 500 index gapped higher by at least 0.5% to start the week. Looking at the equity market's performance for the rest of the day and the rest of the week shows a mixed picture.

How can you explain the government's continued interventions? If the government believes that intervening in the market is in the public's best interest, then the best way to push the market higher is to do it during light futures trading periods (like weekends or after-hours). Why? Because it takes less capital (and thus costs less to do it) after-hours than it would have during periods of thicker trading.

What Do the Charts Show?

The S&P 500 is testing the top of its four month trading range, sitting just under resistance. Will the third time be the charm, or will there be a sell-off from this triple-top ?

The past two times we saw failed rally attempts on declining volume before the market cratered. A sustained move above the 1140 level will likely give the index plenty of room to rally. We'll see.

Sentiment Has Flipped to Bullish.

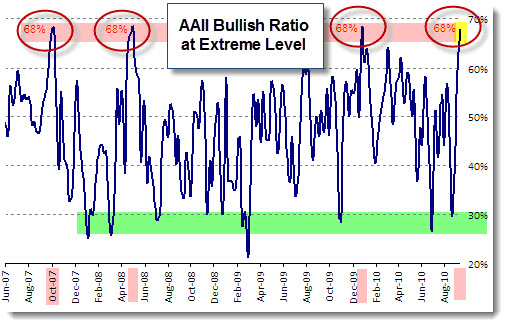

The American Association of Individual Investors (AAII) sentiment survey is interesting to watch. Retail investors are notoriously wrong at market turning points. Consequently, many look at extreme readings of the AAII Sentiment Survey as a contrary indicator. So, where is it now?

Bullish sentiment (meaning expectations that stock prices will rise over the next six months) rose 7.0 percentage points to 50.9%. This is the highest level of optimism since August 13, 2009. The historical average is 39%.

Bearish sentiment (meaning expectations that stock prices will fall over the next six months) fell 7.4 percentage points to 24.3%. This is the lowest level of pessimism since December 31, 2009.

Not only is the data at extreme levels, it also represents an abrupt sentiment reversal. Just four weeks ago in the late August reading of the AAII Bull Ratio (the percentage of bulls divided by the percentage of bulls and bear) fell below 30%. That level of pessimism is often seen at the turning point of significant market bottoms.

In contrast, now we are seeing the opposite side of the sentiment spectrum. The current reading of 51% bulls and only 24% bears, results in a bull ratio of 68% – the highest for the whole year. That level of optimism is often seen at the turning point of significant market tops.

As you can see on the chart, in recent years, we’ve seen this level reached only a handful of times: in late December 2009, May 2008, and October 2007. A quick glance at the chart of the S&P 500 will tell you that all of those instances were much better times for selling rather than buying.

Another market getting a lot of attention lately is Gold.

Billionaire financier George Soros said last week that while gold prices might continue to rise after hitting record highs, he renewed a warning that gold is the "ultimate bubble". With economic and fiscal weakness crimping the developed world, Soros said all investments are at risk because "this is a period of great uncertainty so nothing is very safe." For more of his observations, watch this video.

Business Posts Moving the Markets that I Found Interesting This Week:

- Which Sector Do Experts Believe Will Lead the Next Bull Market? (Barrons)

- Senate Clears $30B Small-Business Measure. (Newser)

- The 10 Biggest Myths About Gold. (SmartMoney)

- Pimco Makes an $8.1B Bet Against Deflation. (InvestmentNews)

- Why Men Do Worse Than Women As Investors? (Forbes)

Lighter Ideas and Fun Links that I Found Interesting This Week

- Bull Market in Men's Cosmetics: Just Don’t Call it “Makeup”. (NYTimes)

- Poll: 1-in-5 Incorrectly Think Obama is a Muslim. (Newser)

- 1st Marijuana TV Ad Airs on a Fox Affiliate in CA: Smell the Taxes? (SFGate)

- Japanese Men Flocking to Resorts With Video-Game Virtual Girlfriends. (TheWeek)

- The 20 Richest People of All Time. The list might surprise you. (BusinessInsider)