This cartoon made me smile.

Are you over the recession?

Earlier this week, the National Bureau of Economic Research (the official arbiter of recession dates) declared that the recession that began in December 2007, ended in June 2009.

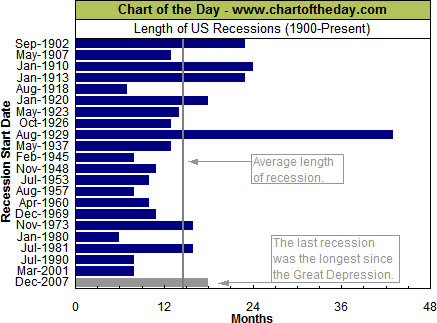

For some perspective on the recession just past (a.k.a. the "Great Recession"), Chart of the Day illustrates the duration of all US recessions since 1900. There are a couple points of interest. Of the 22 recessions that occurred over the past 110 years, the most recent recession is tied for fifth in terms of duration. It is also worth noting that the recession just passed was above average in duration and the longest since the Great Depression.

Well, now that the Great Recession is over, the rest should be easy … right?

What About the Economy – How Did It Do in the Third Quarter?

Clearly, unemployment and housing are two issues that need to improve to kickstart the economy. Moreover, economic growth in the second quarter slowed to an anemic 1.6% from 5.0% in the December quarter, and 3.7% in the first quarter.

Because of this, the Fed has now signaled next round of Quantitative Easing, which likely will send the U.S. Dollar and bond yields to new lows, while sending stock and commodity prices materially higher.

Do You Care if the Market Moves Because of Intervention?

From my perspective, it doesn't matter that intervention is taking the place of the invisible hand and free-market pricing. From a traders perspectives, price is price. And, as I've discussed before, it also makes sense from a practical standpoint. If intervention is the policy, then it is best for it to happen during periods of slow market activity (because it's easier and cheaper to accomplish with less resistance).

Nonetheless, it's also interesting to note how little organic buying and selling is happening in the equity markets. If you remove the moves made by (or on behalf of) governments, the trading required by ETF's or indexes, and the volume that simply comes from program trading or high-frequency trading … there's really not a lot of interest in the equity market right now.

In contrast, however, asset classes like gold and bonds are seeing a lot of interest.

But, if you are looking for something positive, remember that the "powers that be" officially declared the recession over.