Barry Ritholz had a great quote this week.

"If your job is to identify opportunities and risks in the market, you have to recognize that when the Fed is pouring fuel on the fire, when they send their minions out to discuss the Greenspan put, some people rush for the fire hoses … but my job is to go grab some marshmallows and sticks and head over to the Boy Scout jamboree campfire. If your job is a policy analyst, well that’s a different situation. But if you’re an asset manager, you can’t fight the tape constantly. You have to recognize when massive Federal Reserve liquidity is going to goose the market. But I’m not going to argue with people who say this ends badly. Hey, every bull market eventually ends badly. You know, I can’t tell you if it’s a 25% correction or down 1,000 [points]. But you know what? You’ll have plenty of time to make that decision. Right now, as long as they are giving us an opportunity to make some hay, you have to participate while the sun is shining."

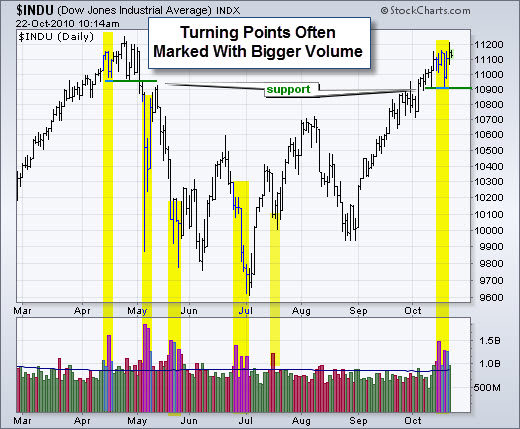

Dow Stalls With High Volume Near April High.

With a surge from 10,000 to 11,200, the Dow Jones Industrial Average is trading near its April highs and close to a 52-week high. However, it has started to stall with high volume. The chart shows the Dow battling the 11100 area with above average volume the last seven days. Arthur Hill notes that the trend since late August is still up. Nonetheless, a high volume stall could give way to a short-term reversal that starts a correction. High volume is often present at or near inflection points.

The yellow areas on the chart show volume surges that occurred at turning points.

For now, the Dow has yet to show any signs of weakness on the price chart. The Average established support at 10,900 with two lows over the last few weeks. This support level looks similar to the April support level. Notice how the April support break provided a clear signal. The bulls are in good shape as long as current support holds. A move below 10900 would argue for a correction that would be expected to retrace a portion of the prior advance.

Are there any other clues we can watch?

How Does the Dollar Affect the Dow?

Looking at the charts below, it is easy to see that there is a strong inverse correlation between the U.S. Dollar and the Dow. According to TSP Talk, this is not always the case … but when it is, it does assist us to predict direction changes.

The upcoming quantitative easing (QE2) by the Fed could be seen as a catalyst for the dollar's decline, as more money being pumped into the system means a weaker dollar. If QE2 is priced-in to the market already, then we could have a “buy the news” reaction in the dollar, which in turn would likely hurt the stock market. In the mean time, the trend is clear.

Business Posts Moving the Markets that I Found Interesting This Week:

- Industrialized Nations Target Currency Policies. (WashingtonPost)

- Why You Should Feel Up When the Dollar Is Down. (TechReview)

- AIG Raises $17.8 Billion in Record Hong Kong IPO. (BusinessWeek)

- Flush With $51 Billion in Cash, What's on Apple's Shopping List? (NYTimes & Forbes)

- Ten Laws of Technical Trading From John Murphy. (StockCharts)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Sun Tzu: The Best Leadership Teacher Of All Time? (Forbes)

- Coffee May Combat High Blood Pressure. (WebMD)

- 10 Most Expensive Zip Codes: Monocles & Top-Hats Not Included. (Advisor)

- Should You Nap at Work If You Really Need One? (Newser)

- Obama Booked to Appear on Jon Stewart's 'Daily Show' & Mythbusters. (EW)

- More Posts with Lighter Ideas and Fun Links.