Next week will tell us a lot about where this market is headed. Three big events will give us a sense of how the market reacts to news from its perch near recent highs.

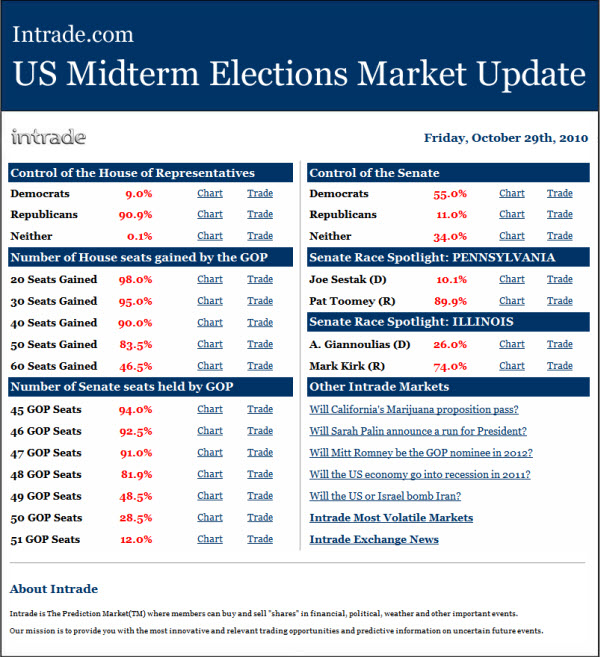

It starts Tuesday, when we get election results. Many believe the market has been waiting for republicans to gain seats. If that takes place, and appears that it will, the market, you would think, will like it. However, some wonder if the news is already priced in to the markets. Here is a chart from Intrade showing how likely people believe it is that republicans gain seats.

On Wednesday, the fed will disclose more about QE2. The market wants to know where Fed Chair Bernanke stands on the critical issue of flooding liquidity. Again, even if the market gets what it wants, will it matter … or has the rally already priced-in the effects of QE2?

The Rally Continues.

The Dow Jones Industrial Average is sitting in a decision zone with overhead resistance from the April recovery highs. This is notable because we are overbought, with negative divergences … yet almost no selling pressure.

A sustained move above the resistance zone, shown in pink, would be a bullish sign.

Down Volume Is Rising … And That Means So Is Risk.

Have you looked at what the New York Stock Exchange's "Down Volume" (DVOL) is showing lately? Marty Chenard, from StockTiming.com did and here is what he found.

Normal behavior in a rally is for the Down Volume to be trending lower.

That means, that as the market goes higher, less selling is occurring. However, rallies always reach a point where profits start to be captured. Since investors cannot take profits without selling, the Down Volume increases as profit taking activity increases.

Such a Down Volume-to-Market relationship pattern can be seen on today's chart.

Notice the rising red lines on the DVOL part of the chart. Those lines show that the Down Volume was increasing as the NYA Index continued to rise. That represented a negative divergence, and sign that investors were taking profits and selling into the rally.

If you look at the first three instances this year, the market soon pulled back after each round of profit taking.

What about the fourth instance?

That is one of those "you are here now" events. Since early September, our DVOL model shows that it has made a higher/low and a higher/high. That is important because that is the definition of an "up trend".

A historical word of caution … if the Down Volume on the New York Stock Exchange index is rising, then risk levels are also rising.

Sentiment Is Approaching Extreme Levels.

The AAII Sentiment Survey shows a jump to a 2-to-1 ratio of Bulls-to-Bears. Readings above 2 tend to be bearish. We saw a reading like this about a month and a half ago and the market rally continued. Nonetheless, if you go back to the 2007-2008 bear market, it was a good early indicator of when to be a seller. Of course, some believe this is a bull market, so the indicator may behave differently. The circled area shows this ratio went much higher during more bullish times in 2005 and early 2006. Still, this bears watching.

Business Posts Moving the Markets that I Found Interesting This Week:

- Goldman Sachs Admits "The Economy Is Not the Market & QE2 Is Not a Panacea". (ZeroHedge)

- Dangerous Economic Misconceptions and a Game Show Mentality. (EconoTwist)

- Paulson Justifies 'Terrible' Choices That Saved the Country from Economic Ruin. (OnWallSt)

- Arguing About Money – What is a Currency War, and How Do You Win One? (Slate)

- Hot Mutual Funds Are Often Great Contrary Indicators. (SmartMoney)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- 20 Global Trends Shaping The Next Decade. (TheNextSiliconValley)

- Can the Kremlin's Silicon Valley Succeed? (TechReview)

- Air Force Publishes Cyber-Warfare Manual. Interesting That It's Public. (US Military)

- Kindle Sales Rocket; Ebooks Outsell Real Books 2:1 (SlashGear)

- Google Is Now Providing Servants to Its Employees (Gawker)

- More Posts with Lighter Ideas and Fun Links.