Image by Simon Miller via Flickr

Image by Simon Miller via Flickr

The Economist's Big Mac index seeks to make exchange-rate theory more digestible. They say it is arguably the world's most accurate financial indicator to be based on a fast-food item.

The Big Mac index is based on the theory of purchasing-power parity (PPP), according to which exchange rates should adjust to equalize the price of a basket of goods and services around the world. For them, the basket is a burger … a McDonald’s Big Mac.

According to this measure, the most undervalued currency is the Chinese yuan, at 40% below its PPP rate. In China, a McDonald’s Big Mac costs just 14.5 yuan on average, the equivalent of $2.18 at market exchange rates. In America, the same burger averages $3.71.

The tensions caused by currency misalignments prompted Brazil’s finance minister to complain last month that his country was a potential casualty of a “currency war”. The Swiss, who avoid most wars, are in the thick of this one. Their franc is the most expensive currency on our list.

The table below shows by how much, in Big Mac PPP terms, selected currencies were over- or undervalued.

The index is supposed to give a guide to the direction in which currencies should, in theory, head in the long run. It is only a rough guide, because its price reflects non-tradable elements such as rent and labor. For that reason, it is probably least rough when comparing countries at roughly the same stage of development.

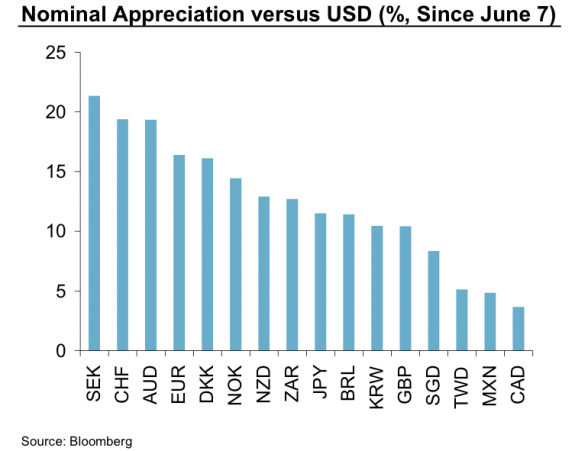

Which Currencies Are Beating-Up On the Dollar?

You know the dollar has been in freefall since the middle of the summer. BusinessInsider posted a chart, from Morgan Stanley, showing which currencies have appreciated the most since then.

The big winner? The Swedish Krona. Note that the much-hyped yen is just in the middle of the pack.

This is insane, very though provoking and startling.

Thanks,

Tom

Wow! thats crazy. Thanks for posting:)