The Markets are at recovery highs.

Traders should remember this important phrase: "Don't Fight the Fed". It applies here.

Think of Bernanke as the manager of the world's largest long-only fund. Further, imagine that his goal was to push prices higher. By the way, you don't have to imagine; he said so. To make sure you get the point, he even announced $600 billion of purchases to be made in the next 8-months – that's $75 billion a month. Regardless of whether you think it will work (or if it will be good for the market or the economy), when money is being pumped into the system at this rate, it is difficult to bet against stocks.

In addition, the market tends to do well after the mid-term elections, and going along with that, the 3rd year of a president’s term is historically the strongest.

With all that, it shouldn't surprise you that the stock market continued its bullish ways as investors seemed to applaud the election results, the Fed's second round of quantitative easing, and a decent jobs report.

Let's Look At Some Charts.

The S&P 500 Index broke out above the April high and closed at its highest level in two years. The breakout is significant – if it can hold. Double tops can produce strong pullbacks, but if the breakout holds, the rallies tend to do well. At point “A” below you can see that breakout in March of this year went on to several more weeks of positive gains until the peak in April.

An Influential Market Sector Is Perking Up.

Many traders believe the financial sector is the most influential group in terms of leading the market. Financials underperformed miserably in 2007 and 2008 and overall market performance followed suit. In 2009, financials outperformed and the market recovered a lot of its prior losses. So, where are they now?

The financials broke above key resistance. The Dow Jones US Financial Index finally broke above its key resistance level (marked by the red horizontal line at 271). With Bernanke's announcement of increased liquidity, as if on cue, the financials led on a relative basis last week and pulled the major indices higher with it. That 271 level now becomes excellent support.

Until the bears can tear down support on the financials at that level, it seems pretty solidly bullish. Expect some of the money that rotates out of other sectors to find a home in financials. That should spell solid outperformance in the near-term.

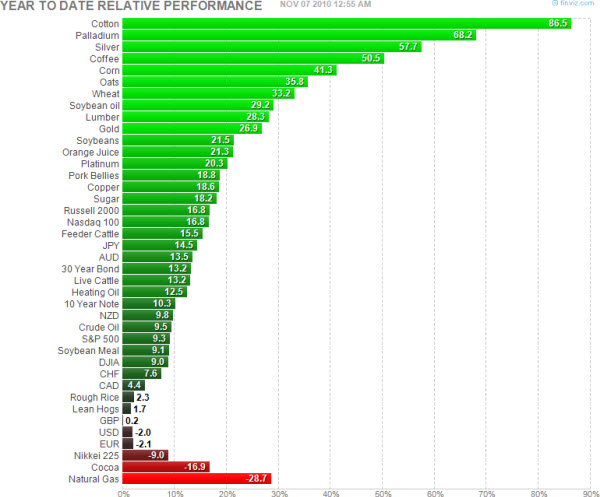

What is Really Out-Performing Year-To-Date?

The following chart illustrates the dominance of commodities so far this year. Check the numbers on the following YTD graphic from Finviz .

Puts things in perspective, and makes me think about inflation.

Business Posts Moving the Markets that I Found Interesting This Week:

- How to Profit From the Fed's New Moves. (WSJ)

- Investors Betting on Inflation are Doing Strange Things to the Bond Market. (Slate)

- Quantitative Easing Is Unloved & Unappreciated – But It Is Working. (Economist)

- Bloomberg's road to the White House. (TheWeek)

- Verizon's CEO Opens Up About Steve Jobs and Negotiating with Apple. (BizInsider)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Tomorrow’s Internet: 1000 Times Faster. (KurzweilAI)

- Dawn of a New Day – Imagining A "Post-PC" World (Ray Ozzie & ZDNet)

- GOP Rout May Be Great News for Obama. (Newser)

- How Forethought (Not Intuition) Separates the Good from the Great. (HBR)

- Down Dog: Can Your Dog Be a Pessimist? A Bowl Half-Full or Half-Empty. (Reuters)

- More Posts with Lighter Ideas and Fun Links.

My response to Don’t Fight The Tape

http://capitalobserver.blogspot.com/2010/11/beware-blanket-statements_12.html