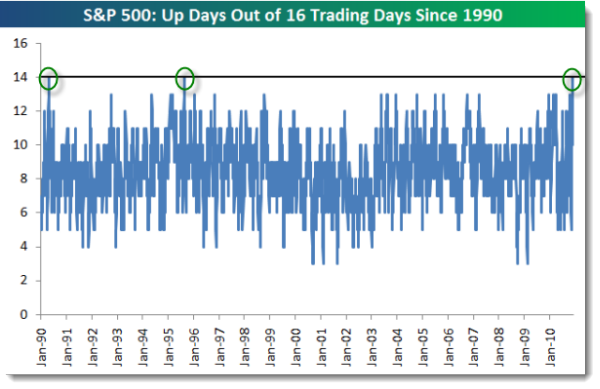

The S&P 500 Index has had quite a run. On Wednesday, Bespoke noted that it has been up 14 out of 16 days. Since 1990, the S&P has only been up 14 out of 16 trading days two other times — once in September 1995 and once in May 1990.

So, You Might Guess That Bullish Sentiment is High.

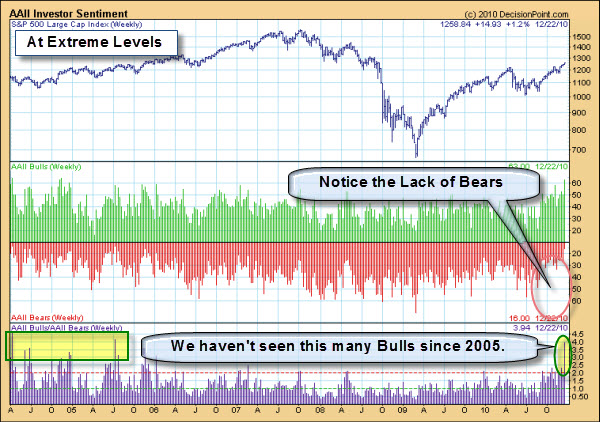

Well, it is probably higher than you realize. We haven't seen readings like this in a long time. The American Association of Individual Investors poll had the highest percentage of bulls (63) since October 2004, and the lowest percentage of bears (16) since October 2005.

Moreover, lots of other sentiment measures are showing similar readings.

Carl Swenlin, from DecisionPoint, reminds that while high levels of bullish sentiment among advisors, investors, and money managers usually occur at market tops, market tops do not always occur when sentiment is very bullish. Sometimes people respond to the obvious and correctly align their market posture with the price trend. In situations like this we have to wonder whether or not they are wrong.

In other words, an excess of bullish sentiment is a caution sign and should cause concern because such sentiment peaks are often followed by price corrections, if not bull market tops. However, that doesn't mean it is safe to use sentiment as a timing tool. Perhaps sentiment is better used as a simple indicator to help paint a picture of the market environment. So far we have no indication from our trend-following models that there are major problems ahead.

Another Measure Brims With Confidence.

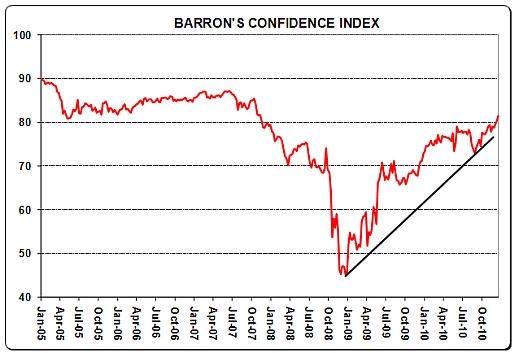

Here is a slightly different take on perceived risk. The Barron’s Confidence Index is a confidence indicator calculated by dividing the average yield on high-grade bonds by the average yield on intermediate-grade bonds. The discrepancy between the yields is indicative of investor confidence. For example, a rising ratio indicates investors are demanding a lower premium in yield for increased risk and thus are showing confidence in the economy.

As shown below, there has been a solid improvement in the ratio since its all-time low in December 2008. This indicates that bond investors have grown significantly more confident, opting for more speculative bonds over high-grade bonds. The ratio is back at levels last seen in October 2007, before the financial crisis.

Presidential Cycle Points to a Bullish 2011.

Here is another piece of data pointing upwards. Historically, the third year for a president produces a good return for investors. Investment strategists Liz Ann Sonders and Sam Stovall say why 2011 will be no different.

Bottom-Line: The economy and stock market end the year stronger than expected. Happy New Year!

Business Posts Moving the Markets that I Found Interesting This Week:

- Forecasters Predict a Strong Recovery in 2011. (NYTimes)

- The Black Swans of 2011 – From Saxo Bank. (PragCap)

- Meredith Whitney Says 50-100 U.S. Cities Might Go Bust in 2011. (BusinessInsider)

- Amazon Sold 8MM Kindles in 2010 – Is There a Natural Limit? (Ritholtz)

- Forbes List of the World's Billionaires – and the New Richest Man. (Forbes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- A Look Back at the Biggest Controversies of 2010 (TheWeek)

- Holiday Spoof: Mariah Carey's "All I Want for Christmas Is … Jews". (Ritholtz)

- "Think and Grow Rich" Download. Great Reading for the New Year. (Entrepreneur)

- The FCC Splits the Internet in Two: Fast or Slow Are Your Choices. (TDB)

- Trick Play Used to Win the TX High School Football State Championship. (BizInsider)

- More Posts with Lighter Ideas and Fun Links.