Beware What You Wish For …

Bears just can't catch a break.

The Market is holding up well. By that, I mean it isn't going down well.

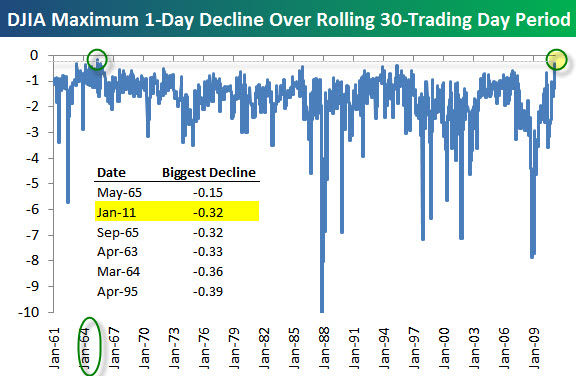

The Smallest "Biggest" Decline in 50 Years.

According to Bespoke, the Dow Jones Industrial Average hasn't had a 1% down day since before Thanksgiving; and Monday's 0.32% pullback is the biggest decline the index has had since the start of December.

It is nearly unprecedented to go this long without having a one-day decline of at least one-third of one percent. Over the last 50 years, Bespoke found just three other 30-trading day periods where the index had a maximum decline of just 0.33%.

Back in April and May of 1965, the Dow went 30+ trading days without declining more than 0.15%. Later on that same year, the Dow had another 30-day period where its biggest down day was just 0.32%. And in 1963, the Dow's maximum one-day decline was just 0.33% over a 30-day period.

Can you really blame investors for being bullish when it's hard to remember what a down day feels like?

Until the Markets have a meaningful correction, Smile … and stay watchful.

Business Posts Moving the Markets that I Found Interesting This Week:

- Top 10 Worst Moments in Fiscal Policy 2010. (CSMonitor)

- Algorithms Take Control of Wall Street (Wired)

- McKinsey Released Its Economic Conditions Snapshot. (McKQuarterly)

- John Bogle Warns That E.T.F.’s Are Risky for Market Timing. (NYTimes)

- RIM Thought iPhone Was Impossible In 2007. (iPhoneHacks)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Perils of the Prediction Game. (BusinessWeek)

- AI Defeats the Hivemind: How a Machine Learning Algorithm Beat the Masses. (TechReview)

- Extreme Fitness For a Hardcore Economy (Forbes)

- Check Out "If the Internet Had Always Existed". (CollegeHumor)

- Timelapse Video of the Recent Blizzard. See it all in 20 seconds (Vimeo)

- More Posts with Lighter Ideas and Fun Links.