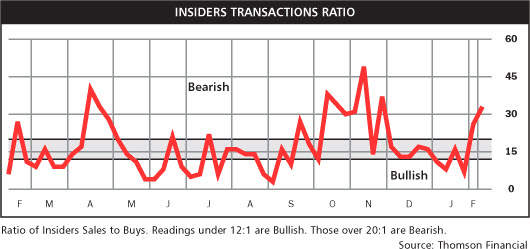

Insider Transactions Show Lots of Selling.

According to Mark Hulbert, corporate insiders have been selling for more than a few weeks while the market has been going up.

While that means the people with the most inside knowledge are selling … it hasn't changed the fact that stimulus continues to push prices higher. Price is the primary indicator. While the torrent of insider selling is unmistakeably bearish, the market has ignored the less important measure.

Here is the insider transaction ratio based on data from Thomson Financial:

Meanwhile, while corporate insiders as a group are busy selling their company’s shares as fast as they can, they have no qualms about issuing buy backs of those same shares with the corporations money. According to Trader's Narrative, US share buybacks are at the highest level since the fall of Lehman Bros. Last week, $27.3 billion buybacks were announced – the highest since September 2008. Companies are continuing to use their massive cash hoard to repurchase shares.

This may make shareholders happy and drive per share earnings growth but many fret that this is a sign that performance is once again being artificially manufactured instead of earned through profitable performance or growth. According to research from Citigroup, 37% of the per share growth of earnings in the S&P 500 may be traced back to buybacks if they match last year’s pace.

Business Posts Moving the Markets that I Found Interesting This Week:

- A Major Top is Unlikely Soon. (Barrons)

- Is Financial Innovation a Good Thing? (Economist)

- Will Intelligent Machines Revolutionize the World's Economy? (Post-Gazette)

- Is the Fed's Meddling Only Prolonging the Financial Crisis? (DailyReckoning)

- What Grows An Economy? Start-Ups That Grow to a Billion Dollars in Revenue. (Forbes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Mental Muscle – Six Ways To Boost Your Brain. (Science&Tech)

- The Next Hacking Frontier — Your Brain? (Wired)

- What Online Ad Companies Know About You? Everything. (Newser)

- The Pentagon's New Cyber-Warriors (Reuters)

- Power Vegans: What do Steve Wynn & Bill Clinton and have in Common? (BWeek)

- More Posts with Lighter Ideas and Fun Links.