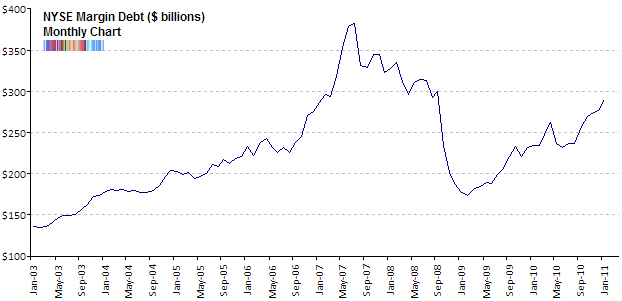

This week's Trader's Narrative Sentiment Overview notes that margin debt is rising sharply as traders and investors increasingly take a more aggressive posture.

Every month, the New York Stock Exchange (NYSE) releases numbers showing how much money was borrowed on margin to buy stocks on the NYSE. As you can imagine, the amount of stock bought on margin is extremely large, but the total number fluctuates quite a bit based on how confident traders are. When stock traders are confident, they borrow more on margin. When stock traders are less confident, they borrow less on margin. Clearly traders are becoming more confident.

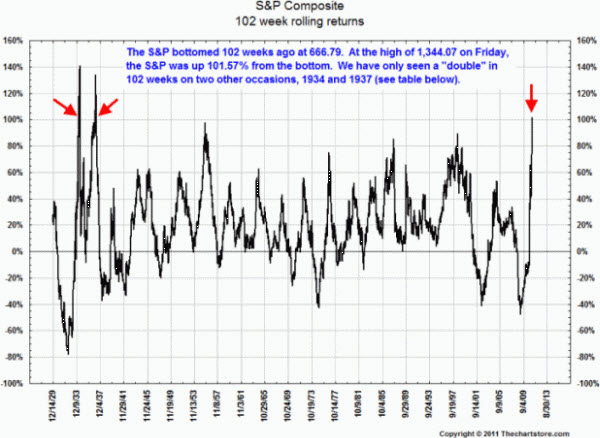

Historically, How Does the Market Handle Doubling Within Two Years?

One such occasion was in 1934, coming off a "very deeply oversold condition" in 1932 and the other one was in 1937. After 1937 and 1934, the 12 months return were both negative, Faber said.

Here is a chart showing 102 week rolling returns for the S&P 500 Composite Index.

These levels of gains have preceded significant pullbacks. Here is a table showing the detail.

This is simply a historical look at similar rally intensities. Nonetheless, Faber warns: "I would be a little bit careful here to just buy the US because investor sentiment is very positive. The volume has been relatively sluggish and the market is extremely overbought by any statistical model".

Price is still the primary indicator. Let's see if traders buy the pull-back?

Business Posts Moving the Markets that I Found Interesting This Week:

- Is Market Optimism an Ominous Sign? (WSJ)

- IMF Warns of New Sovereign Debt Crisis For Largest Economies. (Guardian)

- U.S. & British Exchanges Attacked by Hackers. (SecuritiesTechMonitor)

- Great Visualization of How a State Spends Money. (Jess)

- WSJ Video: Why Are States and Cities Going Out of Business? (Ritholtz)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- The Goal of Business. (Kottke)

- Power Posing Strikes Again: Posture Helps Determine Status. (PsychScience)

- How Egypt Shut Down Its Internet With a Series of Phone Calls. (Wired)

- What's the Longest English Word? Here Are Some Answers …(Kottke)

- The Scale of Starbucks InfoGraphic. (Atlantic)

- More Posts with Lighter Ideas and Fun Links.

Warren thinks like a owner of a business, he doesn’t sell as long as he thinks the business is viable. The past history also shows that their conviction usually applies to businesses they have majority ownership in and not to all. While the author is right to point out that Warren is not pointing out the other possibilities, he should also observe that warren did not ever say that the other possibility won’t happen.

Warren Buffet definitely knows how to buy stocks. The key is to hold on forever!