Sometimes Less Is More – Especially With Government Actions.

Does it matter to you if the markets go higher because of organic growth or because of intervention? On a personal basis it might … but as a trader, the Market is always right. Whether it goes up or down, the trader's job is to find a way to get a decent risk-adjusted return.

In the "Wizard of Oz", as Dorothy and her friends are being amazed by the 'Great and Powerful Oz' …they are told: "Pay no attention to that man behind the curtain."

In the "Wizard of Oz", as Dorothy and her friends are being amazed by the 'Great and Powerful Oz' …they are told: "Pay no attention to that man behind the curtain."

It is great to buy in to the story, but for how long … and at what cost. Sometimes, I find myself shaking my head as I think about the 'man behind the curtain' in this market. Is he "great and powerful" or just a man pulling levers and pushing buttons while hoping the great majority are fooled.

A Lever To Watch – The Interest Rate The Government Pays.

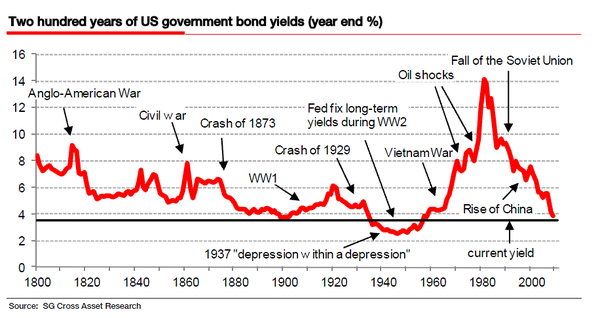

Dylan Grice, of Société Générale, published some research that got a lot of attention. One chart, in particular, caught my eye. It shows two hundred years of US government bond yields.

Commenting on it, the Financial Times and Zero Hedge both noted that as the interest rate that the government pays increases, it will be harder for the government to service and will represent a much larger percent of government revenues.

Till then, well, the market is still going up.

Market Commentary.

The rally continues. In situations like this, the trend is your friend. Nonetheless, I tend to watch for early warning signs. So, here, I am watching the obvious trend-line (marked by the green arrow) on the S&P 500 Index.

If we break below the green up-trend line, bearish traders will likely take that as a sign.

In addition, there are some internal breadth issues and divergences that are worth noting. However, the market measure that caught my eye recently is the increase in the average true range that we are seeing on a daily basis. Volatility often spikes at market tops.

Hope that helps; have a nice week.

Business Posts Moving the Markets that I Found Interesting This Week:

- Are Amazon.com’s Days Of Tax Free Selling Numbered? (Forbes)

- BMW Opens Car Plant Where All Employees are Aged Over 50. (DailyMail)

- Pimco's Bill Gross Slashes Government Debt Holdings. (InvestmentNews)

- Capitalism Without Losers – Three Things I Think I Think. (Pragmatic)

- Are You Better Than A Dart-Throwing Chimpanzee? Research Says Perhaps Not. (BigThink)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- American Idol's Top 13 Ranked, With Song Samples (EW)

- Amazon Takes Aim At Netflix: Now Streams 5,000 Movies & TV Shows. (Insider)

- The Tiger Mom Debate: Why "C" Students Become Billionaire Donors. (WSJ)

- How Writing By Hand Makes Kids Smarter. (TheWeek)

- Where The Streets Have Your Name. Silly But Satisfying. (DataPointed)

- More Posts with Lighter Ideas and Fun Links.

Rather insightful post! By no means imagined that it was this easy after all. I had spent a superb deal of my time in search of someone to reveal this subject matter clearly and you’re the only one which actually did that. Kudos to you personally! Maintain it up!