For the first time in a long time, the S&P 500 Index experienced a small corrective phase. The Index fell 7% from its high, set on February 28th.

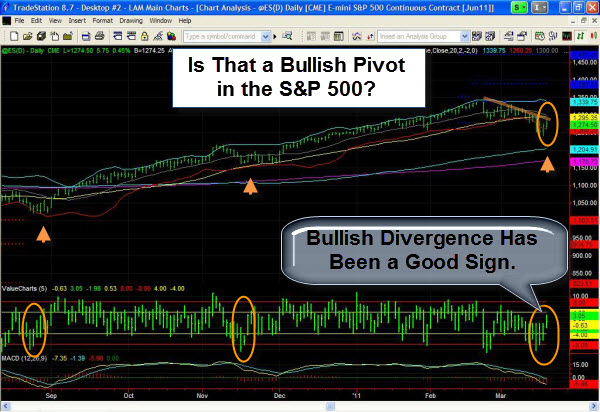

Considering the state of global unrest, the pull-back was reasonably small and orderly. So, is the selling over? David Stendahl, one of the authors of Dynamic Trading Indicators, sent me this chart signaling a potential short term bullish pivot low.

Below is daily chart of the Index and a short term momentum indicator that focuses on mean reversion (David calls it a "Value Chart"). In general, Value Charts respond to extreme movement away from recent norms and signals when the market is likely to reverse course.

There is a short term bullish divergence between price action and the Value Chart indicator. I've marked the last three signals, and you can see that they preceded bullish moves.

The weekly chart, however, shows that the S&P 500 is sitting on support with a number of technical indicators poised to turn to the downside. So, if you are expecting another test lower, there is your cue for caution.

I'm curious whether the market will trigger buyers looking for a bargain, or whether another push lower will result in some real selling?

Is Lumber Sending a Bullish Signal About the Broader Market?

If you are looking for a potentially bullish early indicator, then Lumber may be sending you a signal. It is back near its recent highs. If it can break through to the upside, traders may take that as a good sign of market strength.

Why do traders consider lumber an early indicator for the broader market? Since lumber is a primary raw material in the early stages of new construction, the logic is that lumber purchases signal new construction.

What Can Copper Tell Us?

Like Lumber, traders also look to Copper as another early indicator of new construction because it commonly used in things like wires and pipes. In addition, the Copper/Gold Ratio is an interesting composite measure of economic activity. The chart below shows weakness and a negative divergence of the Copper/Gold Ratio (in comparison to the S&P 500 Index) since last October. Most recently, this ratio has been falling steeply again. We will see if that is an early indicator of broader market weakness?

A similar flattening of trading range occurred in the Financial Sector as well.

What Does the Financial Sector Tell Us?

Financials often lead rallies higher. The logic is that banks make more money when they are lending, doing deals, and helping companies go public. In 2011, investors have been hesitant to buy into further gains in this sector. However, price just put in a volume reversal.

In bull markets, this is where the buying comes in. So, let's see how this sector responds. A move down from here would hurt the bullish case.

Lots of Speculation about Japan.

When disaster stikes a first world country with a first world economy, there is little doubt about re-building. It will happen. The question investors are asking is how they can profit from it?

When disaster stikes a first world country with a first world economy, there is little doubt about re-building. It will happen. The question investors are asking is how they can profit from it?

Someone called me last week and said "I feel terrible for the people and the tragedy, but I also expect to hear that Hank Paulson ends up making billions of dollars on it next year."

That is the mindset of someone looking to put money back to good use. There is still a lot of money sitting on the sidelines. Where will it go to work?

Do you see a rush to invest it in the U.S. equity markets (as we face the end of QE2)? Do you see a rush back into Gold and Silver?

It could be we are about to see an opportunistic shift. It is worth watching where money flows.

Business Posts Moving the Markets that I Found Interesting This Week:

- Buffett Cleans Up On His Derivatives Bet. (Fortune)

- Why the Definition of Probability Matters? (von Mises)

- Reforms Needed to Nurture Capital Markets as Credit Demand Grows. (FT)

- The High Priest of S&P 500 Statistics. (WSJ)

- How to Invest in Japan's Re-Building and Resilience. (Barron's)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- How Great Entrepreneurs Think. (INC)

- Dealing With Information Overload by Supplying Less to Reveal More. (TechReview)

- Great Ideas From The Innovators Summit (TDB)

- The Gorilla that Walks Like a Man. (TheWeek)

- The Universe Is Even Stranger Than You Realize … Video. (Gizmodo)

- More Posts with Lighter Ideas and Fun Links.