Image via CrunchBase

Image via CrunchBase

Pundits are calling for a new tech bubble.

IPOs are going off at the top of their ranges. LinkedIn now has the highest Price/Revenue ratio of any company, anywhere. At LinkedIn's valuation, Apple would be worth over $3 Trillion dollars.

So, clearly all is well in the financial world. Right?

The Canary in the Coal Mine?

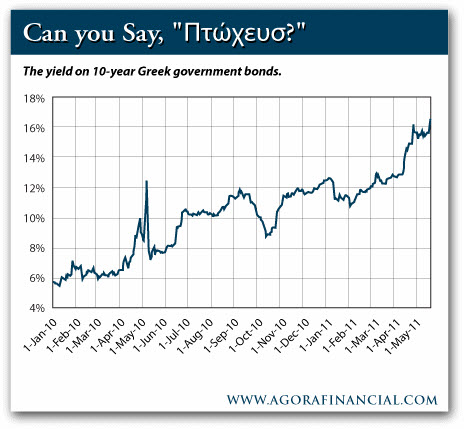

Greek stocks tumbled to new 14-year lows last week, as Greek bond yields rocketed to new all-time highs.

The risk premium says something.

The Daily Reckoning asks why investors are fleeing Greek stocks and bonds faster than a chambermaid flees an IMF Director’s hotel room?

With tongue-in-cheek (and based on 'exhaustive' research), they conclude that investors prefer the securities of solvent entities over those of insolvent entities. But note investors cannot always differentiate correctly between solvent and insolvent.

So, will a worsening sovereign debt crisis in Europe harsh our mellow?

Have the underlying conditions really changed?