Image via Wikipedia

Image via Wikipedia

Typically there are a few major inflection points in the year where assets either switch gears and reverse their prior trends or undergo an acceleration of their current trend.

One of the key predictors of these inflection points, over the last few years, has been a reversal of the general trend of the U.S. Dollar.

Consequently, determining whether the Dollar is at a major inflection point may have considerable implications for asset allocation (bonds, stocks, commodities, currencies) and sector allocation (cyclicals, non-cyclicals) strategies.

Here Is Why the Dollar Can Tell You What to Invest In.

Many traders believe that when the Dollar is weak, the following general relationships are seen:

“RISK ON” Trade

- Stocks outperform bonds

- Investment grade and high yield bonds outperform US Treasuries

- Foreign stocks outperform US equities

- Commodities are strong

- Commodity currencies outperform USD

- Cyclical sectors (Technology, Cons. Disc., Materials, Energy) outperform non-cyclical sectors (Cons. Staples, Utilities, Health Care)

When the dollar is strong, you typically see the reverse of the above relationships.

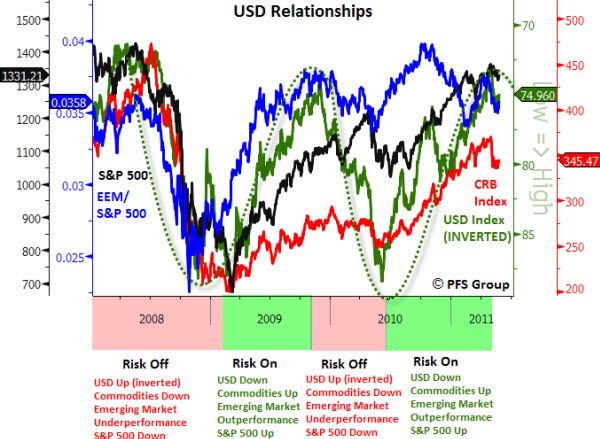

You can see these themes in the data below.

Notice that US stocks (S&P 500), commodities (CRB Index), and emerging market equities (relative to the S&P 500) tend to have an inverse correlation with the Dollar. In the chart above, the USD Index is shown in green (and inverted for directional similarity).

In general, when the USD is rising (falling in chart) commodities and the S&P 500 are weak, and emerging market equities underperform the S&P 500 (2008, early 2010). As stated, the converse is also true (e.g., 2009, late 2010-early 2011).

So, the question is whether you think the Dollar is bottoming?

For more, visit Financial Sense.

Good Info..

Clear explanation on the chart. Thanks

—–

PING:

TITLE: Investing Gold or Silver Gold and Silver Spot Trading

URL: http://www.ftginvestment.com/investing-gold-or-silver-gold-and-silver-spot-trading.html

IP: 50.23.65.194

BLOG NAME: FTGinvestment.com

DATE: 02/14/2012 03:17:41 AM

This is my first choice these days. The Commissions expenses are little. Cash are often marketed easily, often through regional sellers or ads or cl. Costs may differ from supplier to supplier with 5% or more. You usually have to pay in cash. Fo…

—–

PING:

TITLE: Investing Gold or Silver Gold and Silver Spot Trading

URL: http://www.ftginvestment.com/investing-gold-or-silver-gold-and-silver-spot-trading.html

IP: 50.23.65.194

BLOG NAME: FTGinvestment.com

DATE: 02/14/2012 02:40:33 AM

This is my first choice these days. The Commissions expenses are little. Cash are often marketed easily, often through regional sellers or ads or cl. Costs may differ from supplier to supplier with 5% or more. You usually have to pay in cash. Fo…