Is the glass half-full, or is the glass half-empty?

It is all a matter of perspectives, isn't it.

Let's look at one of the positives. Some companies are doing fantastic.

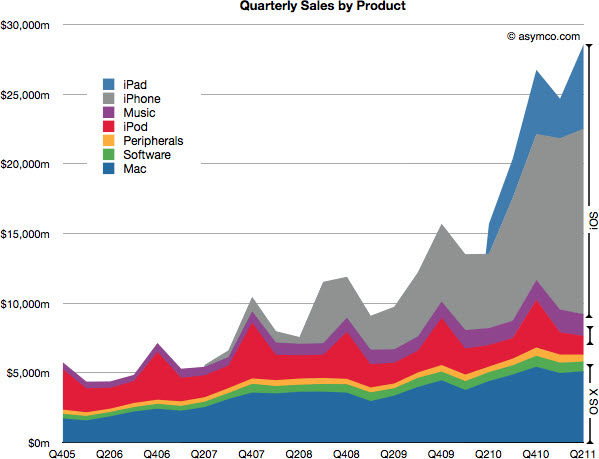

Here is a chart of Apple's quarterly sales, by product.

Apple grew revenues by 82 percent last quarter, which is remarkable growth for a company of its size ($28.6 billion in quarterly revenues).

Can you remember another company, that size, growing revenue that fast? I can't.

You can talk about consumers having less money to spend, negative sentiment, etc. It didn't matter. Apple is showing that cream rises to the top. If you make something people want, they will find a way to get it.

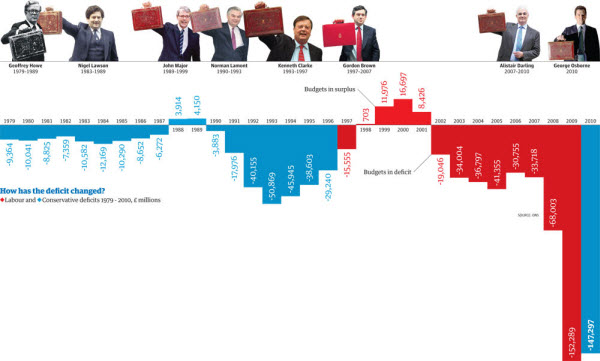

How about the negative? America isn't the only country with debt problems.

Deficit, National Debt and Government Borrowing – How Has It Changed?

How has it changed? It has gotten worse.

Here in the U.S., we talk about deficits, debt-ceilings, and government borrowing, as if we are the only country suffering. But the news shows that this disease has spread through the world (and not just Greece either).

For example, the chart below shows the United Kingdoms deficit over time.

Does it look like a mirror of Apple's success to you? Wonder what that means?

At some point, a crisis is likely. However, the chaos surrounding crisis often results in tremendous opportunity.

Ultimately, it doesn't matter what happens … it is what you do.

Many opportunities present themselves every day in the markets. The goal is to identify what is working, and to trade it while it is working.

Niccolo Machiavelli said: "Whosoever desires constant success must change his conduct with the times."

Perhaps it is time to make some plans so you respond intelligently to what happens.

HMG Note: As I write this, there is still a failure to agree about the debt ceiling.

If it isn't resolved before morning, international response should be telling. Will it spark fear, or will the markets shrug it off? The answer will probably tell you a lot more than the news did.