Sometimes little things can give you big clues about what is happening.

Traders say that market opens are for retail traders, while market closes are for pros.

Well, last week, the S&P 500 Index closed down at least 1%, from its intra-day high on four of five trading days.

Sentiment has been negative; still, the markets have held-up surprisingly well. Until sellers get bolder, this may be just another set-up for a move higher.

Let's Look From a Longer Timeframe.

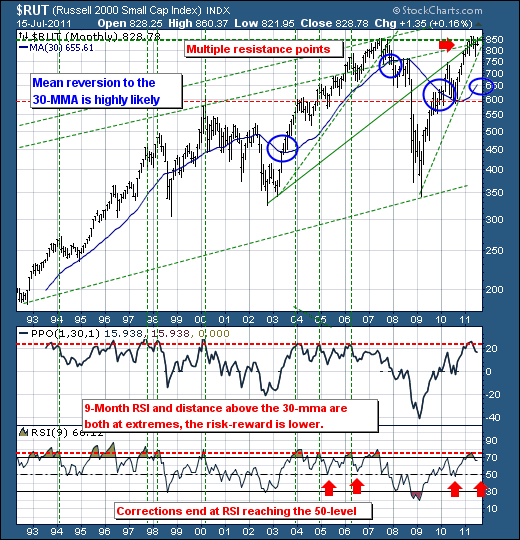

The chart below shows the Russell 2000 Small Cap Index. While it is near highs, the Index is has having difficulty moving past its all-time highs (set in October 2007). As a result, there are indications that momentum is sagging.

Momentum seems like a pretty easy concept to understand. For example, if you a throw a ball in the air, it has the least momentum at its peak. After it hits the new high, but fails to go higher, it starts to fall. Market momentum is a little trickier, because it doesn't always work like the laws of physics.

In the process of the Russell 2000's failure to make new highs, traders may note that several indicators have started to flash "caution".

Richard Rhodes notes that the 9-month RSI hit above the 70-level, while the distance above the 30-month moving average rose to above 20%. In the past, these types of indicator readings have allowed for "mean reversion" lower processes to take place back to the 30-month moving average, while the RSI trades lower towards the 50-level.

This would be a normal correction in a bull market; and it may be the "pause that refreshes" before the market moves higher again. But it is important to realize that a mean reversion exercise would result in nearly a -20% decline from current price levels.

While scary, some would argue that such a pull-back would be just what was needed to put the Bulls back on firmer footing.