Fear is not logical.

Nonetheless, you can often use logic to predict human response to certain emotions and stimuli.

For example, let's look at the clear shift in investor sentiment over the last few weeks.

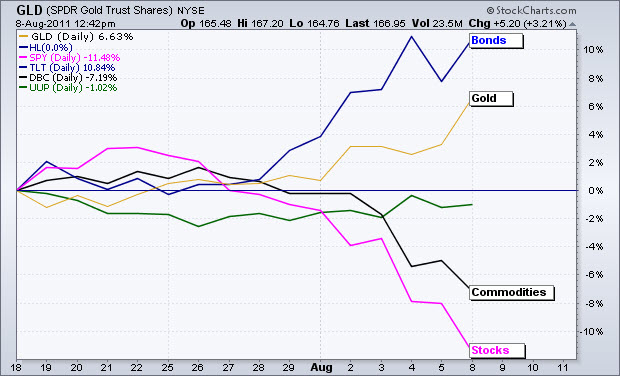

Click here for a live version of this chart.

In short, the money flows show a re-pricing of risk. Stocks and commodities, which are viewed as riskier assets, declined over the last two weeks. Bonds and gold, which are viewed as safe-havens, advanced as alternatives. The Dollar, which is somewhere in the middle is virtually unchanged.

There Are Other Ways to Measure Fear.

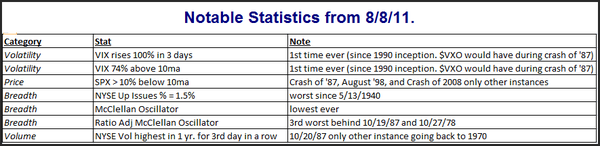

The sell-off of the past few weeks triggered a number of extreme measures. Whether you look at volatility, price action, breadth, or volume, recent readings were off-the-charts. The table below is from Quantifiable Edges. It highlights some of those extremes.

However, every action brings a reaction … what can we expect next?

What Does the Volatility Bring?

We just saw four straight days with moves of 400 points or more in the Dow Jones Industrial Average … a first in its history. Is that just a meaningless market statistic?

Perhaps, instead, it is another indicator that we're at a significant extreme? If so, periods of great volatility are often followed by periods of relative calm. The logic is that bulls and bears fight until one side gives up (for a while); and the market pushes forward in the direction of the winner.

Looking For a Positive Sign? Here's a Promising Trading Signal.

Mark Hulbert says market indicator with perfect record just signaled 'buy'.

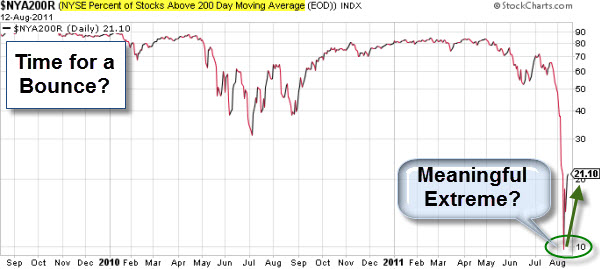

Last week, we got to a point where less than ten percent of NYSE stocks traded above their 200-day average. When the number of stocks that manage to stay above this moving average — a common measure of momentum — make a nasty two standard deviation move to the downside from the norm, it usually means an oversold market and a good time to buy.

The last — and most extreme — oversold position was on March 2, 2009, about around the start of the bull market. Click here for more on this type of chart.

You don't have to like the economy or the markets to trade them.

Hulbert was raising the same sort of empiricism in the March-May 2008 period … all which proved of no consequence in the collapse that followed. Ignore all one wants of unsustainable debt burdens and insolvent megabanks — a condition unique to our time and defying all past comparison — no matter what attractive past comparison one might cite, losing sight of context could prove fatal.

Thanks for your comments. Interesting commentary on your blog.

Trade in certain equity trading strategies to make money in the stock market. If you are new to investing or you lose money trading in the stock market, it is better to learn to act in the market from the best stock trading course.