Traders whose only investment strategy is to buy stocks may be subjecting themselves to unnecessary risks.

There is always something working in the Markets. So, if you limit yourself to looking solely at U.S. Equities, you might be missing something.

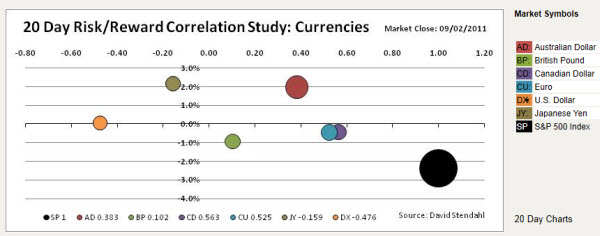

For example, here is a chart (from David Stendahl) comparing the risk and reward of trading various Currencies to the performance of the S&P 500 Index.

Notice that each of these markets recently did better, while also having a very low correlation with the S&P (shown by the big black dot in the lower right of the chart).

The point is that there are many other markets and products you can use to diversify your portfolio and improve your risk-to-reward ratio.

Wherever there is danger, opportunity lurks, and vice versa The two are inseparable … but they don't have to be equal.

What About the S&P 500?

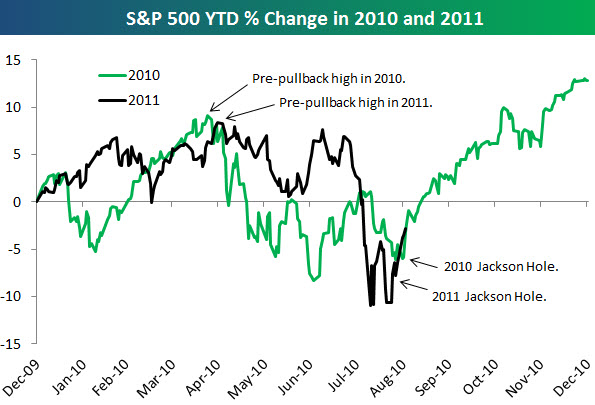

Last year, the S&P 500 made its pre-correction high in late April, and it wasn't until Bernanke's Jackson Hole speech in late August that the market broke out of its summer funk.As shown above, the S&P 500 also made its pre-correction high in late April of this year, and people are hoping that we made a short-term bottom at the end of August right around the time of this year's Jackson Hole speech.In 2010, the S&P 500 was down 3.12% on September 1st, and it closed the year up 12.8% after pretty much going straight up over the last four months of the year.As we enter this September, the S&P currently sits down just under 3%. If history repeats itself, the country will surely end the year in a much better mood than it's in now.Don't expect the market to be that easy though!