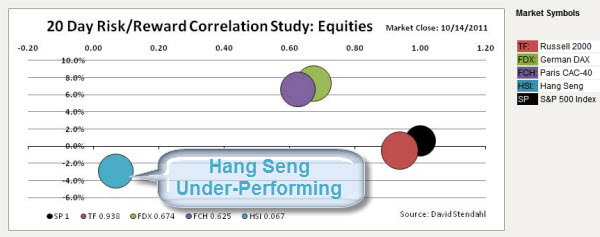

There is a slight, but potentially growing, disconnect between the S&P 500 Index and the Asian stock markets (specifically the Hang Seng).

On Friday the Hang Seng lost 1%. Moreover, looking at the recent price performance action … on a 20 day basis, the Hang Seng acting very different than other world markets.

Signal Financial Group just updated their seasonal chart series for the Hang Seng Index. It indicates that we could be at a turning point, with little upside expected based on historical patterns.

A Little Risk/Reward Exercise in Portfolio Diversification.

If the S&P continues to the upside … the Hang Seng may not follow. Thus, over the next few weeks, some traders may look at a potential Long S&P and Short Hang Seng play.

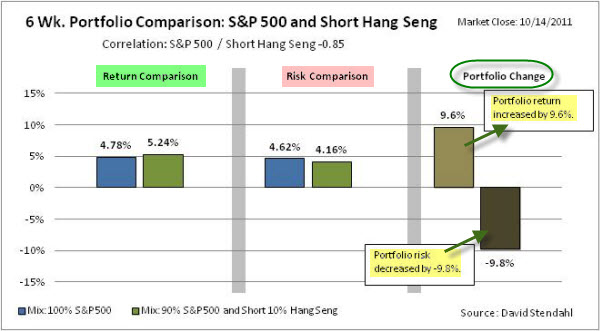

Just as an example, here is a quick look at a portfolio study covering 6 weeks, comparing the performance of a portfolio based solely on the S&P 500 Index versus a portfolio that is long the S&P (using 90% of capital) and short the Hang Seng (with 10% of capital).

Portfolio Allocation:

| Equity Portfolio: | 100% Long S&P 500 Index | |

| Mixed Portfolio: | 90% Long S&P 500 Index and 10% Short Hang Seng |

The chart below provides a basic analysis, identifying the differences between the two portfolios. The chart is divided into three sections: return comparison, risk comparison and portfolio change. The first section shows the percent return figures for the portfolios over a recent six week period. The second section focuses on risk, which is defined as standard deviation of return, over the same six week time period. The final section shows the net percentage change to the portfolio's performance based on the small 10% allocation to Hang Seng.

The diversification helps the risk/reward ratio in the study. That looks like something to watch for in the coming weeks. Hope it helps.