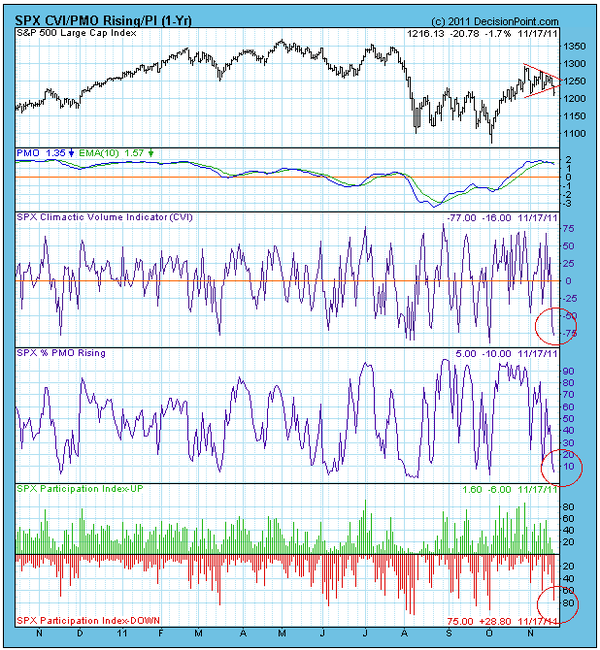

From a chartist's perspective, the S&P 500 Index broke out of its recent triangle pattern by moving lower. This was an unpleasant surprise for bulls, because triangles are most often considered a continuation pattern. As such, when the pattern ends, prices are normally expected to continue in the direction they were trending before the continuation pattern (consolidation) began.

In this case, the breakdown casts a bearish pall on a picture that been bullish since the October low.

A positive aspect to the price breakdown is that a number of ultra-short-term indicators hit climactic oversold readings the same day. On the chart, above, we can see how these oversold spikes generally coincide with the start of rallies of at least short-term duration.

Carl Swenlin at DecisionPoint explains that climaxes are often a sign of either initiation or exhaustion. An initiation climax signals that price will begin moving in the direction of the climax, while an exhaustion climax occurs at the end of a move. Immediately following a climax, prices can chop around for a day or two before the follow-through begins.

So, was the breakdown actually a shakeout, intended to turn people bearish just ahead of a rally?

Unfortunately, we are still on a longer-term sell signal, which means things could be about to get nasty again. The following chart shows a weekly view of the S&P 500 Index. Notice that price could not get back above the up-trend line (marked by the green arrow) or the overhead support-resistance line (marked by the pink highlight).

Other clues? Historically, this is a seasonally bullish time. And trader talk is that markets may pop on a significant government intervention we are likely to see.

All-in-all, it points to another interesting week.