That was quite a move in the markets last week. Was it 'real', or wishful thinking?

Kind of like the jobs number? Does it show an improving economy (with some seasonal hiring), or was the jobs number smoke, mirrors, tomfoolery and skulduggery?

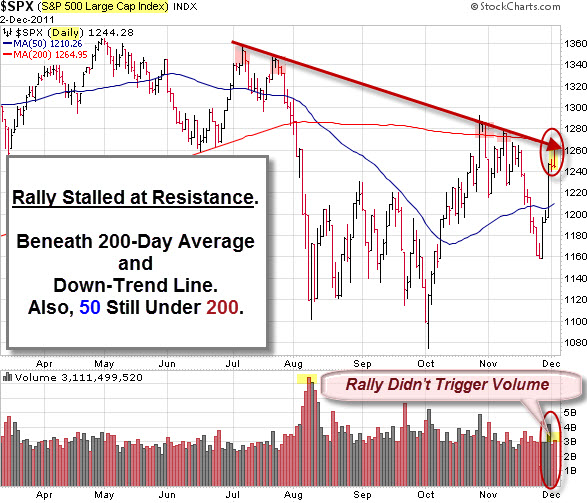

Back to the market, a quick look at a daily chart of the S&P 500 Index shows that the recent rally stalled the resistance. Price is still below the 200 day moving average, and it closed below the recent downtrend line. An impressive rally, to be sure … However, it was the lack of volume on the big push higher that caught my attention.

When a market makes a 7% move (especially without a volume spike), traders are going to notice.

So, while some pros looked to take profits into the push higher – it looks like something finally caught the eye of retail traders.

While not statistacally significant, these examples seemed worth sharing.

While I was getting a haircut this week, I listened as my barber debated the merits of buying Netflix with the barber standing next to him. Likewise, a trainer at the gym wanted to talk about several stock ideas he's considering buying. Meanwhile, several people called to talk about whether to buy American Airlines while it was priced less than a happy meal toy.

We can talk about "smart-money" versus "dumb-money"; but until this, I hadn't seen recent interest in the markets from normal investors.

Perhaps something is stirring the 'animals spirits'.

Without selling pressure, it doesn't take much to push markets higher. So, are you expecting a Santa Claus Rally or a Dumb-Money Mugging?

Time will tell.