David Stendahl sent me some stats that point to some diversification opportunities.

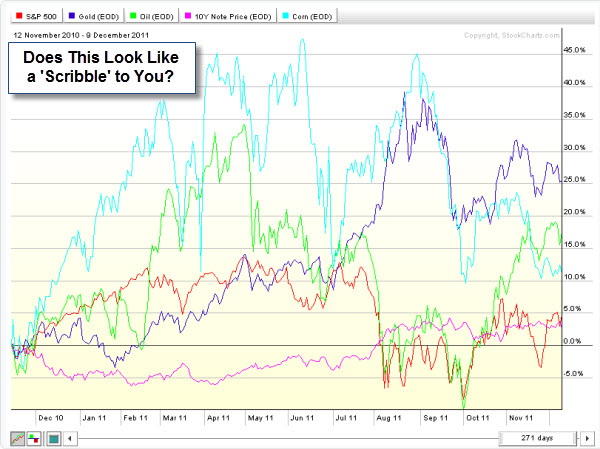

Does the following chart look like a bunch of scribbles? Good; it shows the diversified returns of the S&P 500 Index, Gold, Euro, 10-Year Note, Corn and Crude.

Keep these markets in mind as trading options that often offer performance not highly correlated with the S&P 500 Index.

What follows are a similar set of comments for various markets.

Gold

|

Over the past 14 yrs, the top 20 winning mos. in Gold produced an avg return of 8.3% … |

|

Since 1997 Gold generated a total return of 165.3% based on its top 20 grossing mos. … |

|

Gold generated an avg return of 8.3%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: Gold generated an avg return of 0.6%/mo based on its top 20 grossing mos. since 1997 … |

|

14 year perspective … top 3 monthly returns for Gold 13.4%, 13.2% & 12.3% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for Gold -17.9%, -11.4% & -9.2% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |

Crude Oil

|

Over the past 14 yrs, the top 20 winning mos. in Crude Oil produced an avg return of 9% … |

|

Since 1997 Crude Oil generated a total return of 179.2% based on its top 20 grossing mos. … |

|

Crude Oil generated an avg return of 9%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: Crude Oil generated an avg return of 1.8%/mo based on its top 20 grossing mos. since 1997 … |

|

14 year perspective … top 3 monthly returns for Crude Oil 19.2%, 17.3% & 11.6% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for Crude Oil -23.3%, -15.1% & -13.6% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |

Corn

|

Over the past 14 yrs, the top 20 winning mos. in Corn produced an avg return of 10.7% … the same mos for the S&P 500 returned 1.9%. |

|

Since 1997 Corn generated a total return of 214.7% based on its top 20 grossing mos. … the S&P 500 index returned 37.7% for the same mos. |

Euro

|

Over the past 14 yrs, the top 20 winning mos. in Euro produced an avg return of 5.5% … |

|

Since 1997 Euro generated a total return of 109.2% based on its top 20 grossing mos. … |

Ten Year

|

Over the past 14 yrs, the top 20 winning mos. in 10 Yr. T-Note produced an avg return of 2.1% … |

|

Since 1997 10 Yr. T-Note generated a total return of 42.3% based on its top 20 grossing mos. … |

|

10 Yr. T-Note generated an avg return of 2.1%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: 10 Yr. T-Note generated an avg return of -1.5%/mo based on its top 20 grossing mos. |

|

14 year perspective … top 3 monthly returns for 10 Yr. T-Note 5%, 2.7% & 2.4% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for 10 Yr. T-Note -3.7%, -2.6% & -2.5% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |