The S&P 500 Index is entering a seasonally bullish period. The chart below shows the predicted turning points based on the past five years of historical data.

Something potentially different this year is that the S&P 500 Index has performed pretty well year-to-date. In fact, it is up 12.17% so far … and things look pretty strong until May.

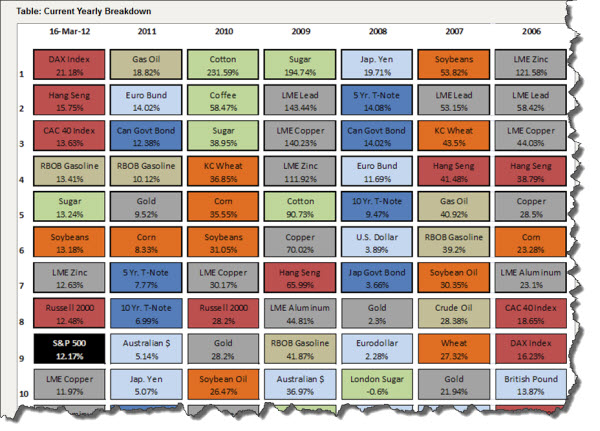

However,the chart below should serve as a reminder that there a lot other markets worth trading too. For starters, the DAX is up 21.18% so far this year.

The chart shows the top-ten performing markets for the past few years. Click the chart to see an expanded version of this data.

Note how much diversification there has been in the top-ten throughout the years.

That is the funny thing about markets … something is always working. The trick is finding it while it's working.

Is something ‘always working’ WITHIN each of these markets though? e.g. US Equities? It costs to jump around into different accounts to trade each of these markets. Trading all of them is quite a luxurious way of life. All I can trade, at least for now is US Equities.

ETFs or Futures makes it possible.