Many traders expected a sell-off after the election. We got that, and now the market is pretty oversold. So, is it time to jump back in … or should you pay attention to signs that we are still in a "Risk-Off" trading environment?

Traders know it is tough to call a meaningful 'Market Top' because you have to be right about both price and time. Adding to the difficulty is that humans seem to be wired to focus on what they missed, so it doesn't take much to trigger buying behavior.

With that said, sometimes it makes sense to pay attention to warning signs. In this post, we'll look at a technical warning pattern some traders call "the four horsemen of the apocalypse". As you probably guessed, it involves four components.

Why are they called the four horsemen? Because when you see all four of these rise at the same time, the underlying message is ominous.

Under normal circumstances, these market symbols are not correlated. In other words, the "horsemen" generally do not ride in the same direction. For example, when gold is going up, the dollar and USTs are normally going down, or vice versa.

When they all rise together, however, it indicates an extreme correlation of "risk-off" and diminished risk appetite across the board.

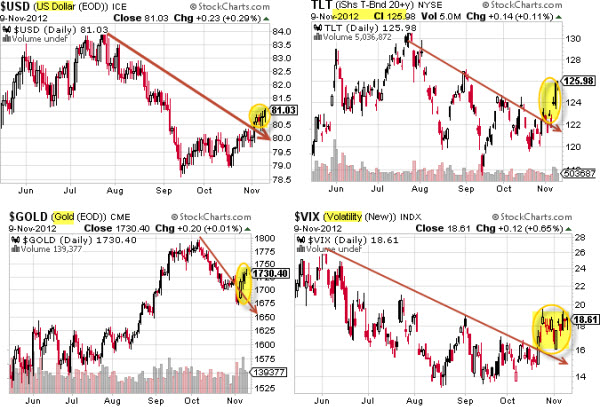

Here is a composite of all four charts. The yellow highlit areas show the coordinated move higher.

According to Mercenary Trader, U.S. Treasuries rise via their designation as the ultimate deep liquidity safe haven instrument.

Gold rises as the "alternative currency" not subject to a printing press — the safe haven for those who fear U.S. Treasuries are booby-trapped.

The Dollar rises as US investor capital is repatriated from emerging markets (and foreign investor capital flows into bonds).

And the VIX rises as equity risk assets are being shunned …