Pop Quiz! What line item is the largest asset on Uncle Sam’s balance sheet?

- U.S. Official Reserve Assets

- Total Mortgages

- Taxes Receivable

- Student Loans

The correct answer, as of the Flow of Funds report for Q1 2012, is … Student Loans.

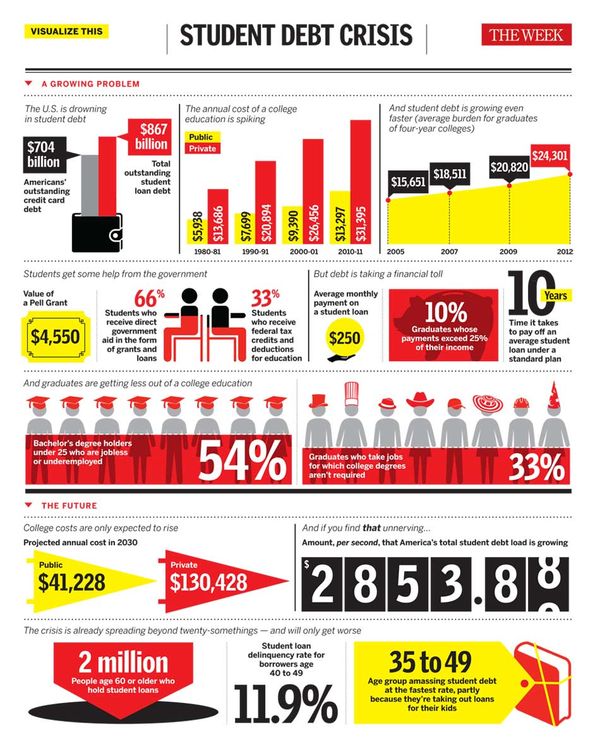

The rapid growth in student debt has been a frequent topic in the financial press. Earlier this year the Consumer Financial Protection Bureau (CFPB) posted an article with the attention-grabbing title: Too Big to Fail: Student debt hits a trillion .

Student loans may be a liability on the consumer balance sheet, but they constitute an asset for Uncle Sam. Just how big? Nearly 35% of the total federal assets, over four times the 8.6% percent for the total mortgages outstanding.

The nation's total student debt load is growing at a terrifying $2,853 per second.

Here, an infographic.

Could this be a catalyst to the next market turmoil? Seems woth watching.

Student loan debt has popped up above all the news and has left every debt behind, something very controversial. The rise in the debt is quite frequent which is hindering the GDP and economy of the country which is speeding up day by day. No one’s Uncle Sam can have control on such situation as this bubble is now going to burst.

There’s been a quite saturation in the market and due to overwhelming there are many companies, the question here is: which one is best suited for our need or for the students. This is a bubble bursting topic and the quickquid scheme would be more inherit to student’s debt.

I think there is a need to revisit and do situational analysis to this students’ loan problem. The government should pay much attention to this issue.

Well the statement made by Veasley is quite coherent, the Government should certainly step forward and not a small step but a huge step in favor of students, so that they can be saved from drowning. Not only simply starting campaigns and programs would solve the matter but some sturdy measures have to be taken to overcome the situation.

With the drastic increase in the loan companies there are many claiming to be the best and are easily providing loans to the consumers. But the things are not likely to be the same, so be precautious and alert when dealing with any loan company or lender.

I am a product of student loan. Without this, I cant able to reach the position of what I have now because of financial stability. If there is something wrong with it I think that’s not a students factor but its a government factor.

The increased education cost is pushing the future of students into dark and so the number is increasing of students falling into debt. The government should certainly come forward with some instant measure to overcome the situation or else the debt crisis would keep on increasing.

http://www.kwikcash.co.uk

it’s possible that a community bank loan under this program might be made to a business that is not qualified as “small,” I’m guessing it’s not likely. Under the Small Business Jobs Act, qualifying loans (up to $10 million) may be made to applicable business that are “small” — meaning, the business has annual revenues of $50 million or less. As always, though, an institution lending under this program, should verify compliance with the Act’s requirements. I don’t see this affecting relationship banking.

small business loan

One of the major and common problems around the world which has reached its bubble bursting point. The student loan will have prescribed effect on the economy which seems to have broader allegation that probably needs effective attention. Government is also taking keen interest but is quite handicap solving the main issue, for which students are sacrificing.