A big part of successful trading is to identify what is working, while it is working, and to seize the opportunity while it is available.

The opportunity can be demonstrated using a sailboat analogy. The stronger and longer the wind blows the faster and further the sailboat should move. Conversely, in the absence of wind, we wouldn't expect movement. The best sailboat in the world is not going to go anywhere without some sort of wind.

Expanding the analogy, it is normal for winds to be blowing in most markets (trends) and occasionally for there to be strong winds in some markets (sustained trends).

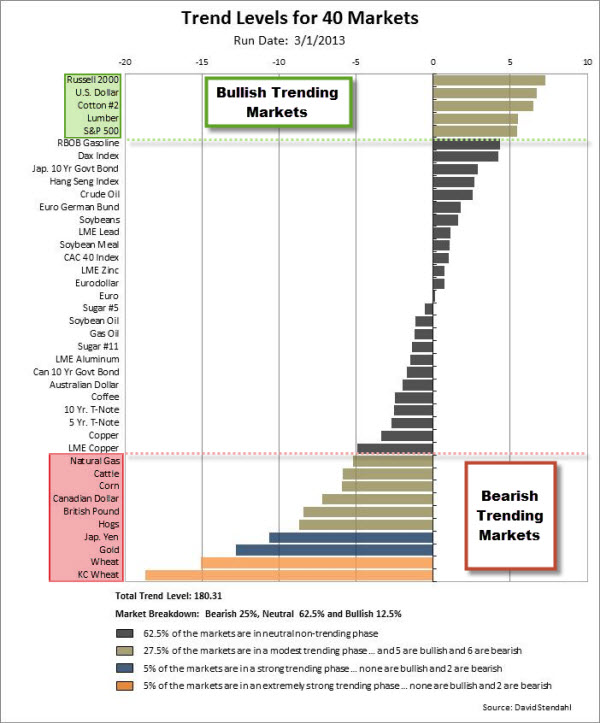

Here is a chart showing the current Trend Levels for 40 markets.

Click here to see a yearly market performance comparison.

Note that while some high profile markets have been in an up-trend, there are more and bigger down-trending markets at the bottom of the chart.

In general, Trend Level ("TL") values greater than +5 indicate the presence of a noteworthy up move (or up-trend) and TL values less than -5 indicates the presence of a noteworthy down move (or down-trend) in the markets.